2018 UK BPS ENTITLEMENT TRADING UPDATE – 11th APRIL 2018

ENGLISH NON-SDA

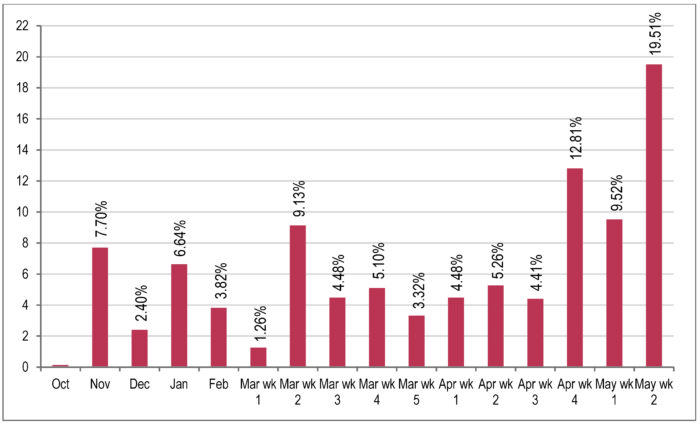

We are now in the last four weeks of trading and it is worth remembering how the market has behaved in previous years. Set out in the bar graph below is the spread of our trade for the 2017 season, which shows that over 40% of our season’s trading took place in the last three weeks. We suspect this will be repeated and even intensified this year as applications are left later and later for BPS claims.

Percentage volume of all 2017 Non-SDA sales in months and weeks

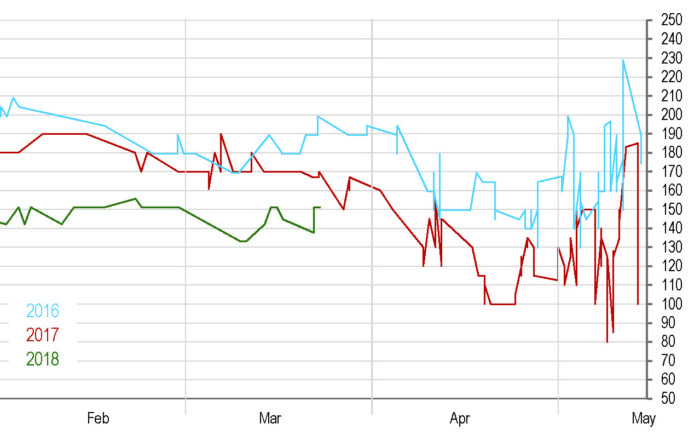

The graph below illustrates how volatile the last few weeks can be in price and how what has been a declining market recently could easily bounce back.

2016, 2017 and 2018 Non-SDA VAT registered sales >10 hectares – February to May

For up to the minute prices on Non-SDA contact Hugh Townsend – telephone 01392 823935.

ENGLISH SDA

Trade in SDA has picked up in recent weeks, with the price having firmed again to £200-£210/ha, following a dip at the end of last week to £180/ha. Supply at present remains steady as farmers and agents work their way through BPS claims, although potential purchasers would be encouraged to contact us at their earliest convenience to avoid missing out as demand picks up toward the deadline and in previous years there has not been enough supply to meet demand. For up to the minute prices on SDA contact Jake Loftus – telephone 01392 823935.

ENGLISH SDA-MOORLAND

The Moorland market continues at an even pace, with most recent sales agreed at between £60-£65/ha, although surges in supply and demand are expected as the market becomes more volatile in the final weeks of the trading season. For up to the minute prices on Moorland contact Jake Loftus – telephone 01392 823935.

RPA ONLINE ISSUES – 2018 ENTITLEMENT TRANSFERS

There are, as ever, a number of odd quirks to the RPA online entitlement computer system records and processes this year, and understanding as many of them as possible should help those buying or selling entitlements steer through the possible pitfalls, or at least be forewarned. We set out below a few that we have come across so far.

Transfer applications submitted, but then not confirmed by the RPA

We have now submitted a substantial number of transfer applications online for 2018, and most (over 95%) have been confirmed by the online computer within a matter of hours of the application being submitted. However there have been some that were not confirmed automatically and, in our experience, this is usually due to one of the following two problems:

Transferor/Seller has not yet been paid for his 2017 claim

There are still a small number of farmers who have not yet been paid their 2017 BPS claim (and often when queried the RPA say there is no particular reason why, they are simply at the bottom of the pile), and in these cases the RPA online onscreen entitlement records for that seller will show that no entitlements have been used in 2017. Where this is the case, the seller’s entitlements are not confirmed on the RPA online system as being available for 2018, and therefore the computer cannot transfer them to another party. This can be despite the fact that the seller fully activated all their entitlements in 2016, and the RPA’s usage rule for entitlements is that they only need to be activated fully once in every two years.

This is in essence a “computer glitch” that the RPA operatives cannot get around, and in these cases, although the RPA will usually, when pressed, confirm that the transfer will be effected (back-dated to when the transfer application was submitted) once the computer has updated the claim status for that seller, they are unable to guarantee when this will be done. As the RPA 2017 payment window gives them until the 30th June to complete all claims, and given that the RPA are now at their busiest time of year dealing with telephone queries relating to 2018 claims, it seems ever more likely that transfers from sellers who have not yet been paid for 2017 will not be confirmed until after the 15th May deadline.

Buyers therefore should not necessarily panic if an online transfer to them does not go through automatically, but if they are concerned they could ask that the seller (or his agent) confirms they activated their entitlements in full in 2016.

It should also be noted that, if a seller finally receives his 2017 BPS claim payment after a transfer application has been submitted, they should not assume that the transfer will then get pushed through automatically. In our experience a seller will need to arrange for their agent to contact the RPA and notify the Entitlement Team that they have now been paid, and ask them to “push through” the transfer(s) that are pending.

Active Farmer Declaration not being made by the buyer before a transfer application is submitted

It is now clear that any new entrant, or anyone who has previously only submitted a paper claim, may not be recorded on the RPA online computer as being an “Active Farmer”. (If you have made a successful online claim in 2017, you will automatically be recorded on the online system as an Active Farmer.) Despite the RPA confirming there is now no need to be an “Active Farmer” to submit a BPS claim, or have entitlements transferred in, they have not yet been able to update their online system to remove the need for a buyer/transferee to make this declaration in order for the computer to allow the entitlements to be transferred to them. Despite us advising all buyers that they must make this declaration, this sometimes gets overlooked. So what happens then?

Once a transfer application has been submitted to someone who has NOT made their Active Farmer declaration, the transfer is put in “pending” by the RPA computer. Neither party will be contacted by the RPA to be told there is a problem, or why the transfer is held up, so it is down to the person/agent submitting the transfer applications to check the status of transfers regularly.

If a buyer makes the online Active Farmer declaration after a transfer application has already been submitted, the seller or his agent will need to contact the RPA Entitlement Team and ask them to “push through” the transfer in order to get it confirmed, as once the transfer is in “pending” the computer does not automatically process them even when the block to the transfer is removed.

We have noted a number of cases where entitlements that were not claimed on in 2017 have disappeared from a farmer’s online entitlement screen in 2018, despite them being claimed on in full in 2016. When we raised this with the RPA we were advised that this is due to “a system anomaly causing surrenders to generate incorrectly in the first year of non-use, [and] several claims have been affected by this scenario”. In most cases the records otherwise correctly show the use of the entitlements since 2015, and it is clearly a computer glitch, and where this is the case we have had success in contacting the RPA and arranging for the incorrectly clawed-back entitlements to be returned to the seller without too much difficulty. However all BPS claimants would be well advised to login and double-check that their held entitlements are showing correctly, before they submit their claim, and to contact the RPA if they have any queries.

RPA online system anomaly resulting in entitlements being incorrectly “clawed back” in the first year of non-use

Leased entitlements not showing separately from owned entitlements

A recent issue that has come to light is where a seller who agreed to sell all his entitlements and entered into a contract with a buyer, then realised that the RPA online computer had included in the Total Owned column a number of entitlements that had been leased in to them on a long-term lease in 2015, which was due to end in March 2019. We queried this with the RPA, who confirmed that the leased-in entitlements were indeed included in the Total Owned column, and explained: “The reason the [leased-in entitlements] are not showing in the leased column of the balance screens is because there appears to have been a migration issue on this SBI when the entitlements data was brought over into SITI from the old RITA system”.

In this instance our client will purchase entitlements next year to ensure they have entitlements available to be transferred back to the lessor upon the end of the lease. However it will be of concern to landlords or anyone who has leased-out entitlements to discover the entitlements they have leased out, (and which are theoretically “safe” and prevented from being sold by a tenant as the RPA online entitlement transfer system does not allow you to transfer out leased-in entitlements, only “owned” entitlements), could in fact be showing as “owned” by the farming tenant, and could be vulnerable to being sold by that tenant without their knowledge, either by mistake or not.

Incomplete entitlement history showing online

We have also come across a number of cases where clients’ entitlement records are simply incorrect, or missing, i.e. the farmer has claimed successfully and been paid in 2015 or 2016, and yet their online entitlement records do not show that any entitlements have been used in one or all those years to correctly reflect this. In the case of one of our clients, he had been paid in full in 2015 and 2016, however was still awaiting payment for 2017. We looked at the online records to confirm the usage in 2016 so that he could sell the entitlements with confidence despite not yet being paid for 2017, but found the 2016 screen did not show that any entitlements had been used. An email to the RPA resulted in them confirming that the entitlements were indeed activated successfully in 2016 via checking their “back-end” screens, however they were unable to amend the incorrect “front-end” online screens that we all see, and could only suggest that the error would be resolved once the 2017 claim was processed and “run through a system based transition which should refresh the use by years allowing them to be transferred or used.”

All farmers would be wise to double-check their entitlements status, and also the historic records of their entitlements in 2017, and then further back if 2017 looks incorrect. If you then discover you have any of the above anomalies, you may wish to raise this with your agent, contact the RPA yourself, or alternatively contact us and instruct us to raise this with the RPA on your behalf.

SCOTTISH REGIONS 1, 2 & 3

The Scottish trading season came to a close on the 3rd April, marking the end of this firm’s busiest trading season since the start of the current scheme. Average multipliers for each Region were: Region 1 – 1.37 times face value; Region 2 – 1.29 times face value; Region 3 – 1.3 times value. Prices became highly volatile in the final weeks of trading, with entitlements being bought and sold at multipliers as low as 0.8 and as high as 1.7 times face value.

WELSH

Trade in Welsh entitlements remains strong despite a dip in prices in recent weeks to as low as 0.5 times face value. Entitlements are currently changing hands at between 0.7 and 1 times face value. With only 14 working days remaining until the 30th of April trading deadline, prices are expected to become even more volatile day-to-day and we would encourage those looking to buy or sell to contact us at the earliest opportunity.

NORTHERN IRISH

Northern Irish entitlements continue to trade at between 1.0 and 1.5 times face value, with both low- and high-value entitlements being bought and sold.

UK REGIONAL COMPARISON OF “FACE VALUES”

Note about entitlement values and multipliers

Farmers and agents alike often express confusion over how entitlements from each of the four nations in the UK are traded, as the method used to value entitlements for sale differs between England and the devolved powers.

English entitlements are sold for a specific value – for example £125 per hectare for Non-SDA or £60/ha for SDA-Moorland. This is because all English entitlements are paid a flat rate per hectare. Prices take into account the greening payment.

Due to the historic payment element of entitlements in Scotland, Wales and Northern Ireland as they move to a flat rate, these entitlements are sold using a multiplier. We call this the Regional Method. These multipliers are based on the Basic Payment element of the entitlement for the scheme year in which they are being sold, and do not take into account the greening payment or redistributive payment (Wales only). For the 2018 year most agents have used the 2017 BPS exchange rate of €1 = £0.8947 to calculate the sterling value of the entitlements. Low value entitlements will be increasing in value, and high value entitlements will be decreasing in value as they move to the flat rate.

Below are some examples:

- A Scottish Region 1 entitlement has a 2018 Basic Payment value of €150 (£134.20). It is sold for 1.2 x face value. This means it is sold for €180/ha (£161.05).

- A farmer’s Welsh entitlements have a Basic Payment 2018 value of €90 (£80.52). They are sold for £90/ha. This means they have been sold at a multiplier of 1.12 x face value.

An interesting comparison can be made when the same technique is used when looking at the sale of English entitlements: English Non-SDA entitlements have a 2017 Basic Payment value of €180.46 (£161.46).If they are sold at £125/ha, this would mean they have been sold at a multiplier of 0.77 x face value.

The table below shows the current trading values of entitlements across the UK, using the Regional Method*:

| Nation | Multiplier |

| English Non-SDA | 0.77 – 0.92 (£125 – £150/ha) |

| English SDA | 1.19 – 1.31 (£190 – £210/ha) |

| English SDA-Moorland | 1.35 – 1.46 (£60 – £65/ha) |

| Scottish Region 1 (Trading Closed 3.4.18) | 0.9 – 1.7 |

| Scottish Regions 2 & 3 (Trading Closed 3.4.18) | 0.9 – 1.7 |

| Welsh | 0.6 – 1.0 |

| Northern Irish | 1.0 – 1.5 |

*It is important to note that the Regional Method is based solely on the pre-FDM Basic Payment element of entitlements and does not take into account any Greening or Redistributive payments.

DEADLINES FOR UK ENTITLEMENT TRANSFER APPLICATIONS FOR 2018

England: 15th May 2018

Scotland: 3rd April 2018 (Closed)

Wales: 30th April 2018

Northern Ireland: 2nd May 2018

ENGLISH BPS CLAIMS

When applying for the 2018 Basic Payment, agents and applicants have to consult the 127-page guide. With a booklet this long it is easy to overlook simple elements that can affect an application. Below are a few things not to miss when completing an application.

- Natural surfaced tracks are eligible for the BPS claim if they are used as part of an agricultural activity, are not part of a transport network, and do not provide direct access from public roads to houses, farmyards or buildings or directly linking houses, yards and buildings in different parts of a holding.

- Grass strips between parcels are eligible to claim upon providing the land is greater than 0.1 ha, is able to be grazed and is being predominantly used for agriculture.

- Watercourses which are less than 4m wide for the majority of the length and form part of a parcel boundary are eligible to claim on. Watercourses which are not boundaries are also eligible if the overall area of ineligible features in the field does not exceed 0.01 ha.

- Trees need to be considered carefully when calculating the eligible area of a holding as they may be considered eligible if agricultural activity is carried out underneath them.

- Trees in a line are now classed as a hedge.

For more information on the BPS scheme click here.

For assistance with your BPS claim click here.