Entitlements – Sale, Lease & Delinkage

BPS Transition for England and Delinkage payments – BPS in Scotland, Wales and Northern Ireland to continue

BPS in England will be phased out in favour of the Environmental Land Management scheme see here.

The last English BPS application would have been submitted in 2023. From 2024 de-linkage will apply, with payments received automatically based on the average claim during a ‘reference’ period of the 2020, 2021 and 2023 claim years. This means that English entitlements will no longer be needed nor will you need to farm any land to claim the remaining years of BPS. See our tables below for payment values. Although English entitlements are no longer tradeable the delinkage reference amount will be tradable during an early 2024 window.

Basic Payment Entitlements in Scotland, Wales and Northern Ireland can still be sold, leased or transferred through inheritance. They can be sold or leased with or without land. Sales without land are the easiest to deal with and are the most popular method of trading. VAT is payable on Entitlements traded (sold or leased) without land, unless the seller is non-VAT registered. Unless otherwise stated all entitlements are offered for sale without land and VAT will be due on the price agreed if applicable. Any entitlements listed are offered subject to contract.

We can offer advice on the sale, lease and transfer of entitlements, along with naked acre letting, and the pros and cons of each type of arrangement. Our experience of the entitlement market means that we are able to offer strategic business planning advice in respect to the UK Agricultural Subsidies and advise how to best safeguard your interests throughout the Basic Payment Scheme and beyond. We also offer professional services including:

- Land registration – here

- GPS mapping – here

- BPS claims – here

- Checking the land eligibility for inclusion in your claim – here

- Advising on Cross Compliance – here

- Young Farmer Scheme – here

- New Entrant Scheme – here

- Ecological Focus Areas (EFA) – here

- Crop diversification – here

- Submitting Basic Payment claims – here

- Agri-environment schemes – here

- Dual claims – here

- RPA/RPID/RPW/DAERA disputes – here

Please note we also only act on a subject to contract basis, or subject to the submission of RLE1 forms or actioning online transfer applications, when buying or leasing entitlements for our clients. We do not enter into oral contracts on behalf of any of our clients. Entitlements listed may include lots offered by other agents where prices quoted would include an introductory commission payable to Townsend Chartered Surveyors.

‘Delinkage’ Trading

Delinkage in England: trading of reference amount

- Delinkage reference amounts (based on claims from 2020 to 2022) may be transferred between two businesses in 2024

- Sellers do not have to have made a 2023 BPS claim

- Buyers must have made a 2023 BPS claim

- Delinked payments will be taxed as income – it is not yet known how the sale of reference amounts will be taxed

- Delinked payments will be made in August and December each year until 2027

- All or part of the reference baseline claim may be transferred and to multiple businesses.

Businesses which did not make an English Basic Payment Scheme (BPS) claim in 2023 may now benefit from delinkage by selling their reference amount, which is based on claims made in 2020 to 2022.

Updated guidance from the Rural Payments Agency (RPA) recently set out how delinked payments will be handled in cases of inheritance or where a business structure has changed, for example through merging with or splitting from a business which had previously claimed.

However, these are just examples and potentially any business eligible for a delinked payment may effectively sell the right to that payment to a qualifying business, which is one that made a 2023 claim.

A ‘transfer window’ in early 2024 will allow for the transfer of the reference amount from one business to another. Whilst we await further information on how this will be implemented or the exact qualifying criteria, it will create a market for any farmer to sell this reference data in return for an upfront payment rather than waiting for their bi-annual payments up to 2027.

If the vendor’s own reference amount is greater than £30,000, they can only sell all of it in one lot to one purchaser or nothing at all. However, if there happens to have been land transferred (by gift, sale or inheritance, on letting out or surrender under an FBT or AHA) out of the vendor’s business prior to the 16th May 2023 but after the 15th May 2020 (otherwise there would be no reference amount to transfer) to another business, that other business can purchase part of the vendor’s reference amount. There could be multiple purchasers if multiple lots of land were transferred. We do not yet know if the transferred reference amounts will have to correspond proportionally to the areas of land that were transferred.

Otherwise, apart from the above exemption and maybe also further proof being required or limitations applied, at this point it seems open to any business (if the Purchaser claimed in 2023) to sell or buy reference amounts, a significant opportunity to those who did not make a claim in 2023.

English BPS payment values for 2023 and 2024

The 2021 payment values and each subsequent year until 2027 are worked out by applying certain percentage reductions against the 2020 payment rate for each type of entitlement.

The payment reduction bands for BPS in England up to 2027 will effectively function similarly to income tax, with the first band of reductions applied to the first £30,000 taken from the Scheme, with the next level of reductions to the next £20,000, and so on.

| Entitlement value pre-reduction based on value in 2020 | Percentage reduction applied by band and year to 2020 Entitlement Value | ||||||

| English Region | Entitlement Value (2020) | Payment Band | Scheme year | ||||

| 2021 | 2022 | 2023 | 2024 | ||||

| Non-SDA | £233.22 | <£30,000 | 5% | 20% | 35% | 50% | |

| SDA | £231.57 | £30,000-£50,000 | 10% | 25% | 40% | 55% | |

| SDA Moorland | £63.95 | £50,000-£150,000 | 20% | 35% | 50% | 65% | |

| >£150,000 | 25% | 40% | 55% | 70% | |||

We have provided guesstimates (highlighted green) for the values of delinkage payments in the table below. The only confirmed year is 2024.

|

Payment per Non-SDA entitlement (£) |

|||||||

| Payment Band (Payment Value per entitlement) | Claim year – unit value in each band | ||||||

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | |

| ≤ £30,000 (up to 128.64ha) | 221.56 | 186.57 | 151.59 | 116.61 | 87.46 | 58.30 | 29.15 |

| £30,000 – £50,000 (128.64-214.39ha) | 209.89 | 174.91 | 139.93 | 104.95 | 78.71 | 52.47 | 26.24 |

| £50,000 – £150,000 (214.39-643.18ha) | 186.57 | 151.59 | 116.6 | 81.62 | 61.21 | 40.81 | 20.4 |

| > £150,000 (over 643.18ha) | 174.91 | 139.93 | 104.94 | 69.96 | 52.47 | 34.98 | 17.49 |

|

Payment per SDA entitlement (£) |

|||||||

| Payment Band (Payment Value per entitlement) | Claim year – unit value in each band | ||||||

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | |

| ≤£30,000 (up to 128.64ha) | 219.99 | 185.26 | 150.52 | 115.79 | 86.84 | 57.89 | 28.95 |

| £30,000 – £50,000 (128.64-214.39ha) | 208.41 | 173.68 | 138.94 | 104.21 | 78.16 | 52.10 | 23.45 |

| £50,000 – £150,000 (214.39-643.18ha) | 185.26 | 150.52 | 115.79 | 81.05 | 60.79 | 40.52 | 20.26 |

| >£150,000 (over 643.18ha) | 173.68 | 138.94 | 104.21 | 69.47 | 52.10 | 34.74 | 17.37 |

|

Payment per Moorland entitlement (£) |

|||||||

| Payment Band (Payment Value per entitlement) | Claim year – unit value in each band | ||||||

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | |

| ≤ £30,000 (up to 128.64ha) | 60.75 | 51.16 | 41.57 | 31.98 | 23.98 | 15.99 | 7.99 |

| £30,000 – £50,000 (128.64-214.39ha) | 57.56 | 47.96 | 38.37 | 28.78 | 21.58 | 14.39 | 7.19 |

| £50,000 – £150,000 (214.39-643.18ha) | 51.16 | 41.57 | 31.98 | 22.38 | 16.786 | 11.19 | 5.60 |

| >£150,000 (over 643.18ha) | 47.96 | 38.37 | 28.78 | 19.19 | 14.39 | 9.59 | 4.80 |

| = Guesstimates |

Lump-sum exit scheme

In 2022 DEFRA offered an “exit scheme” where retiring farmers would receive a lump sum payment in place of Direct Payments. This figure will be 2.35 x the average figure claimed between 2018-20 and capped at £100,000. Applications are now closed.

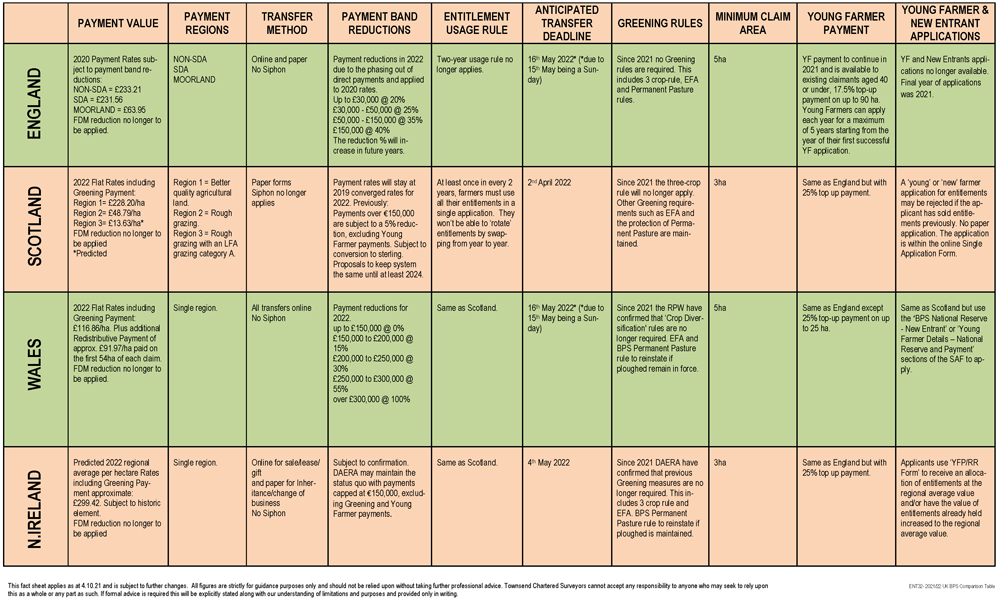

UK Regional Comparison Fact Sheet 2022

To download/print a copy click here

Entitlement trading in Scotland, Wales and Northern Ireland

Whilst England have a confirmed plan for BPS payments to be phased out by 2027, the regions all differ. In Scotland BPS is expected to continue in the same format until at least 2024. In Wales, BPS will also likely remain the same until 2024, subject to funding. An Agriculture (Wales) Act is intended to be introduced in 2024 with plans for a Sustainable Farming Scheme to replace BPS. DAERA have yet to confirm their long-term intentions for BPS in Northern Ireland, however there are indicators that future schemes will combine environmental works with holding entitlements or there equivalent. For further information on entitlements in the devolved nations please use the following links:

Unless specifically instructed in writing we are unable to provide advice in respect to the Basic Payment Scheme or any other schemes under the Common Agricultural Policy of the European Union, especially as to how they may affect a particular vendor’s or purchaser’s eligibility for the Basic Payment Scheme.

Any such comments or statements made by Townsend Chartered Surveyors verbally during the process of buying, selling or leasing entitlements, or leasing for naked acres or otherwise cannot be relied upon unless such advice is provided in writing following receipt of written instructions for Townsend Chartered Surveyors to provide such advice. Any such oral comments or statements do not form part of entitlement agency contracts.

Information

If you sell entitlements through us, you will need to authorise us on the relevant paying agency’s online system. This is a simple process, details of which can be found here for the RPA online system. For information on authorising us on the RPID, RPW and DAERA online systems please contact Alasdair Squires (email).

If you would like to receive our most up-to-date market information and news, please send an email to Hannah Smallridge to be added to the mailing list.

Please click the links below for our historic English SPS Entitlements sale price graphs, English SPS Naked Acres rental price graphs, 2015 English BPS Entitlements trading price graphs, 2016 BPS English Entitlement Trading graphs, 2016, 2017, 2018, 2019, 2020 and 2021 UK Entitlement Trading Market Reports. If you would like a formal valuation of either your entitlements or naked acres, please contact us.

- Historical SPS entitlement graphs 2006-14 – here

- Historical naked acre graphs 2006-14 – here

- BPS entitlements trade graphs for 2015 – here

- UK BPS Regional Comparison Fact Sheet 2016 – here

- BPS English Entitlement Trading Graphs – 2016 – here

- 2016 UK Entitlement Trading Market Report – here

- 2017 UK Entitlement Trading Market Report – here

- 2018 UK Entitlement Trading Market Report – here

- 2019 UK Entitlement Trading Market Report – here

- 2020 TCS Brokerage UK Market Report – here

- 2021 TCS Brokerage UK Market Report – here

Hugh Townsend

FRICS. FCIArb. FAAV.

01392 823935

enquiries@townsendcharteredsurveyors.co.uk