2020 TCS Brokerage UK Market Report

To download/view please click here

1. UK ENTITLEMENT TRADING – CLAIM YEAR 2020

1.1 2020 ENGLISH BPS ENTITLEMENTS OVERVIEW

1.1.1 As we entered the 2020 trading period, the information from the Government was that 2020 would be the last year of the UK government paying the Direct Payment “on the same basis” as the BPS in England, and thereafter, from 2021 onwards they would continue paying a reducing sum until 2027 (however they did not advise whether entitlements would be needed to make claims). The Agriculture Bill also gives the prospect of “de-linkage” whereby the subsidy would be de-linked from the land, and one would no longer even have to farm the land to qualify for the annual reducing payment. In addition, this payment could be paid as one lump sum for the whole five years from 2022 based on what the farmer/landowner was paid in a yet to be announced reference year or years. However, there still remained some confusion and uncertainty which affected the management decisions of the farming sector and their confidence in buying entitlements. The average prices for entitlements in 2019, for instance, were considerably less than in 2018, being £111.65 plus VAT for Non-SDA in 2019 (and £127.17 in 2018, £156.49 plus VAT for SDA in 2019 (and £192.07 in 2018), and £39.10 plus VAT for SDA Moorland (as opposed to £65.11 in 2018), and it was therefore expected that the 2020 season could see a further drop in the value as there was believed to be maybe only one further year to claim in 2021.

1.1.2 On the 12th September 2018 the then Environment Minister Michael Gove, issued a press release announcing the first draft Agriculture Bill 2018. In his press release he stated: “For 2019, Direct Payments will be made on the same basis as now, subject to simplifications where possible. Direct Payments for 2020 will also be made in much the same way as now. Simplifications will be made as soon as possible, subject to the terms of the overall Brexit implementation period. There will then be an agricultural transition period in England between 2021 and 2027 as payments are gradually phased out.” This Bill did not make it through Parliament before Theresa May stepped down as leader of the Conservative party and the subsequent appointment of Boris Johnson as the new Prime Minister which led to the election of a new Parliament. The new Bill was reintroduced in January 2020 with the same timetable of Direct Payments continuing until, and reducing from, 2021 onwards.

1.1.3 Under the reintroduced Bill, from 2025 onwards, the Government proposes that in addition to the reducing Direct Payments, there will be new support mechanisms available in the form of the Environmental Land Management scheme (ELM) which aims to pay “public money for public goods”, and replace the Direct Payments as a way of supporting farmers/landowners.

1.1.4 However, there was still no detail set out in the Bill for how farmers/landowners would actually submit their claims for the Direct Payments that are continuing until 2027. Will they have to make annual claims and need to hold entitlements following a possible de-linkage from 2022? Will they be automatically paid a reducing lump sum based on what they claimed in a previous reference year or years? Therefore those buying entitlements in 2020 only had surety that the entitlements were needed for the 2020 and 2021 claims.

1.1.5 The 2020 season, however, will forever be linked to the COVID-19 outbreak, which certainly put a dampener on markets and caused problems for some farmers with cash flow and staffing for seasonal crops. As a key industry, farmers and all the associated food production line businesses, including land agents and entitlement traders etc, were encouraged to continue working, however no one can deny things were definitely different to previous years. The pandemic also slowed the Agriculture Bill’s passage through Parliament.

1.1.6 The 2020 season took a while to start, and the first sales were agreed in December 2019 at £155-160 plus VAT. By January the price had dropped down to £125, and in early February dropped further to £115, and from that point the market was dictated by supply and demand. Initially we had a good supply, and most sales throughout March and April were agreed at around £100-110. However by the last week of May supply had dried up and buyers had to pay up to £200 per entitlement where we were able to source them.

1.1.7 How our graphs are prepared

As before, we are publishing raw data graphs illustrating in detail how the different regional Entitlement markets behaved during the 2020 trading period, which for England ended on the 15th May 2020. Because we use only raw data, there have been no adjustments such as averaging prices for a week or a day, rounding up or down, and any contributions towards the vendor’s sale costs made by purchasers of small lots on top of the purchase price per entitlement are excluded. These graphs show the results of each individual transaction.

1.1.8 General market factors in 2020 trading period

1.1.8.1 On the 3rd January 2020 the Agriculture Bill 2019-2021 was re-introduced to Parliament, and although its main focus was looking to the future of support mechanisms for farmers/landowners beyond BPS, it did confirm that support would be paid in 2020 “on the same basis” as in 2019 by the UK Government (rather than the EU), i.e. by making a BPS claim.

1.1.8.2 There was also again mention in the Bill of the (reducing) BPS payments being made from 2021-2027 based on a “reference year” rather than having to make a claim each year, and how these could possibly be paid as a lump sum to assist in retirement, reinvestment or diversification planning for farming businesses to enable them to cope with a future without direct area-based subsidy support. It was felt that these proposals could encourage farming businesses to maximise their claims for the next few years to ensure they received the maximum possible payment during 2021-2027.

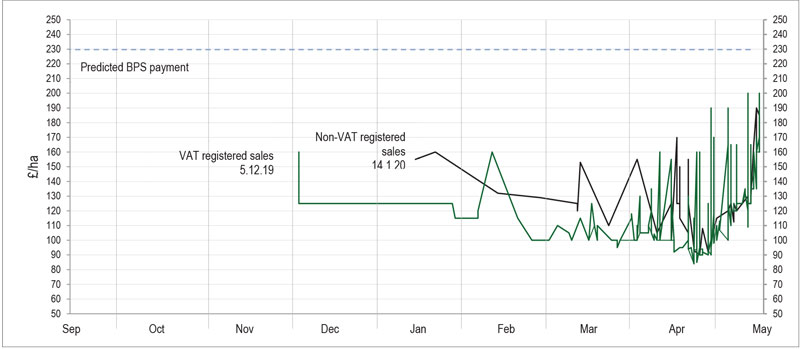

1.1.8.3 As the funding for the 2020 Direct Payments comes from the UK government and not the EU, there was no need to refer to exchange rates and it was assumed that the 2020 payment would be broadly the same as the 2019 payment (i.e. £232.88 for Non-SDA, £231.15 for SDA and £63.42 for Moorland). However this has yet to be confirmed.

1.1.8.4 In 2020 the online entitlement transfer screen went live at the end of January.

1.1.8.5 In 2020 the BPS online claim forms were available from the 13th

1.1.8.6 In 2020 on the 23rd March the UK government announced a country-wide lockdown due to COVID-19 which led to delays and uncertainty for every profession, including farming and food production (despite being a key industry). This affected farmers’ cashflow and confidence, and caused major staffing issues for those reliant on migrant workers for harvesting etc.

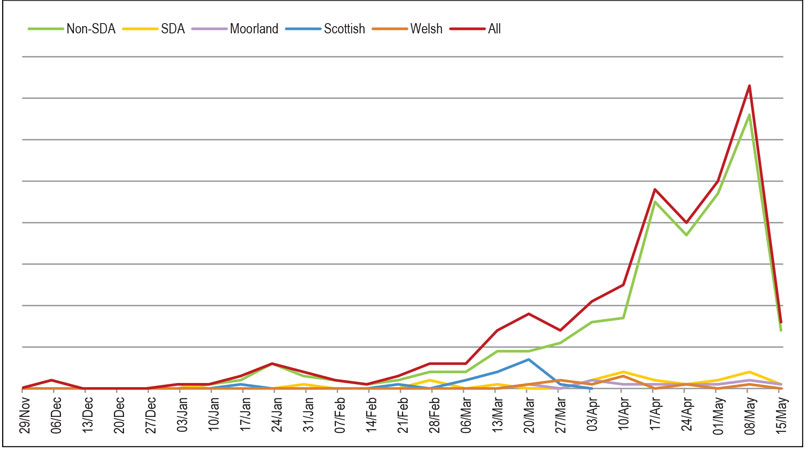

1.1.8.7 Although many agents/buyers contacted this firm in early 2020 wanting to buy entitlements, most were very happy to wait until the last couple of weeks before the deadline to actually buy. This may be simply due to many agents not being able to confirm their client’s shortfalls until the last minute (no doubt due to farmers themselves leaving their BPS claims later and later), and also to usually canny purchasers wanting to buy at the end at what had traditionally been the bottom of the market, when sellers are nervous that they won’t secure a sale before the deadline. Those buyers expecting to get a bargain in the last few days however were sorely disappointed this year, as in fact the price had almost doubled due to a shortage in supply.

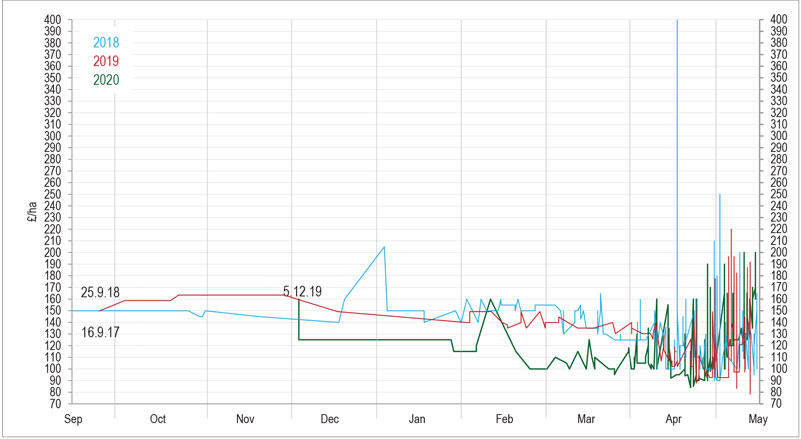

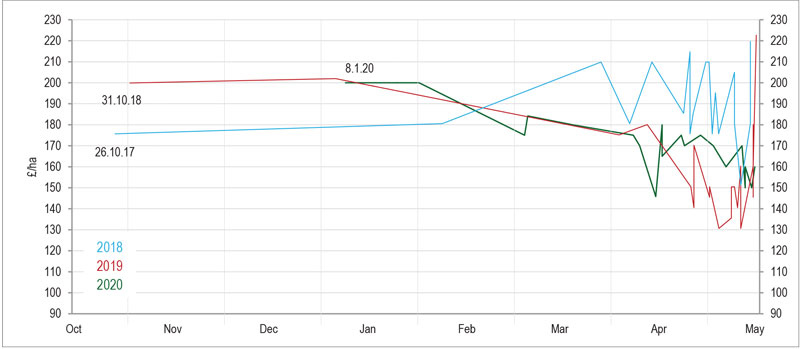

1.2 ENGLISH NON-SDA (VAT registered)

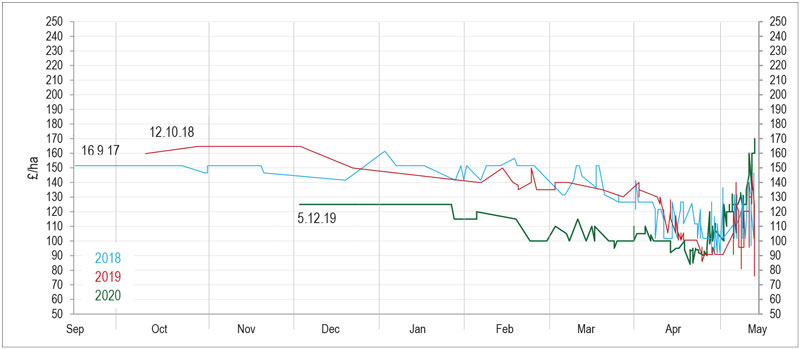

1.2.1 The first sales were agreed in early December 2019 starting at £155-160 plus VAT (higher than the average price of £111.65 for entitlements sold in 2019).

1.2.2 A few further sales were agreed in January with the price dropping to £125 plus VAT.

1.2.3 In early February some larger buyers came to the market, and some sellers with large amounts of entitlements to sell agreed sales at £115-120 plus VAT for big lots. Smaller lots were still trading at £130-160 plus VAT depending on how small a lot, and non-VAT sales were agreed at £132.

1.2.4 By the end of February, however, more sellers had also come to the market, and the usual supply and demand dynamic meant that the price began to soften. Sales were therefore agreed at between £100-110 (for large lots) as we moved into March, with a few no VAT sales achieving £120-125 and by the latter part of March most reasonable size lots were being sold at £100 plus VAT per entitlement.

1.2.5 In the last few days of March demand picked up, but likewise so did the supply of available entitlements from sellers. Supply never exceeded demand however and the price rose slightly to £105-110 depending on the lot size.

1.2.6 By the first week of April a number of sellers were ready to accept lower offers, as they wanted to ensure they got something for entitlements they would lose if they did not sell. The buyers who had offered previously under the market price were mostly now able to agree purchases at £100 (depending on lot size), with non-VAT achieving £105.

Graph A – Non-SDA VAT registered sales of >10 ha

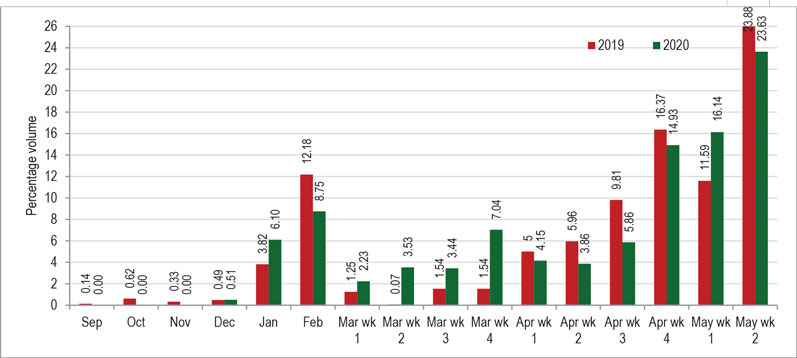

Graph B – Percentage volume of all Non-SDA sales in months and weeks

1.2.7 By the end of the second week of April, with now only just over a month until the 15th May deadline, sales were continuing to be agreed at around £100, with a non VAT sales achieving £125 and one small lot achieving £160 plus VAT.

1.2.8 In the third week of April some nervous sellers with large blocks to sell began to accept offers at under £100 plus VAT, and buyers jumped in and agreed purchases at £92-95 plus VAT. Over the next week many sales were agreed at £95 for mid-large lots, and some small lots (less than 5 ha) or no VAT lots were sold at £125-155 per entitlement. Lots also continued to be sold at £100 plus VAT.

Graph C – 2020 Weekly flow of trade

1.2.9 Sales continued to be agreed at £90-95 plus VAT until the end of April, with higher prices being achieved for non-VAT sales, or small lots.

1.2.10 By the 1st May the supply of sellers prepared to sell at £90 (i.e. those who would lose their entitlements if they did not sell them in 2020) had just about dried up, and buyers who contacted us looking for a last minute bargain instead found the price was rising. From the 1st May sales were being agreed at £108-125, and demand started picking up.

1.2.11 Unlike in previous years, we began to have difficulty in meeting demand in the last few weeks before the deadline, and those sellers who had hung on until the end were mostly able to achieve prices in the region of £120-130 for reasonable size lots, and as much as £190/£200 for smaller lots.

1.2.12 On the 12th May the price rose to £135 plus VAT, and by the 13th it was £160 plus VAT. On the 14th one sale was agreed at £170, but some more entitlements came on and sales were agreed at £140 -190 plus VAT. On the 15th May sales were agreed at £160- 200 plus VAT with the average lot price being £172.

1.2.13 Overall, the average sale price for Non-SDA entitlements 2020 was £119 per entitlement, a slight increase on the 2019 average of £112.

1.2.14 As usual in previous years in 2020 late trading in the last three weeks saw 54.5% of the season’s total trade for Non-SDA. See graph B above.

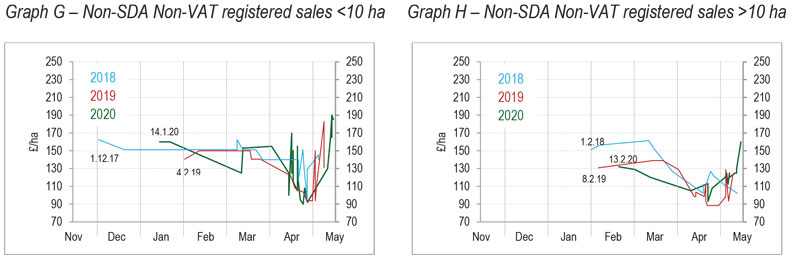

1.2.15 Demand for small lots

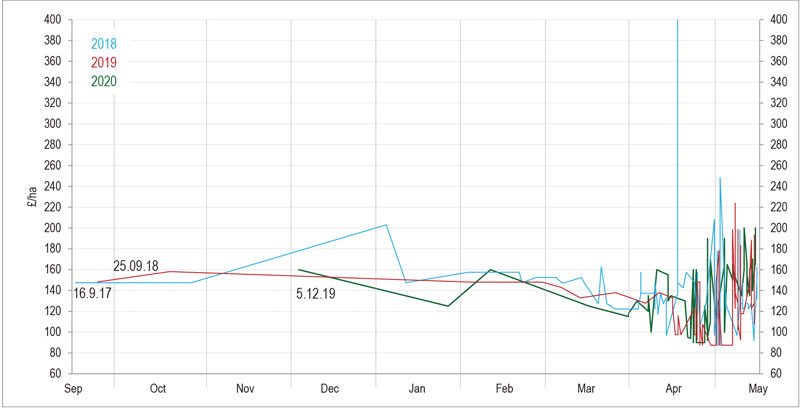

1.2.15.1 As can be seen from Graph D below, the demand for smaller lots was initially low with a slower start compared to previous years. The first deal was concluded in December with a price agreed at £160 per hectare.

1.2.15.2 Deals were agreed at a steady rate throughout January and February with the price falling to £125 in January before returning to £160 in February.

Graph D – Non-SDA VAT registered sales of <10 ha

1.2.15.3 The value dropped throughout March before entering a final volatile period. Purchasers and vendors had been focussing on their BPS claims, realising they had smalls amounts spare or required. This influx of demand, plus the looming deadline pushed up prices with lots achieving highs of £200 per unit.

1.2.15.4 The average price paid for 2020 Non-SDA entitlements (of all lot sizes) over the whole of the season (Dec 2019 to May 2020) was £119 plus VAT.

Graph E – Non-SDA VAT registered sales – all lot sizes

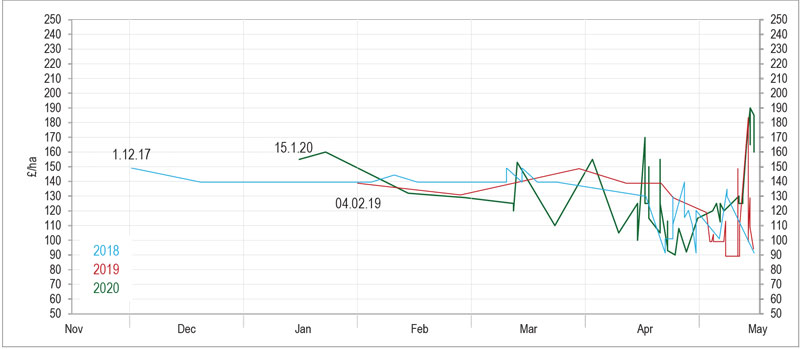

1.3 ENGLISH NON-SDA (Non-VAT Registered)

1.3.1 The Non-VAT market was relatively small this year, in terms of both sellers and buyers, which meant that in practice non-VAT entitlements were frequently sold to VAT registered buyers, meaning that often no premium was achieved. Even where deals were agreed between non-VAT buyers and sellers, this rarely resulted in a significant premium above VAT prices.

1.3.2 In the final week of trading sales were completed at prices ranging from £120-190 depending on the lot size, with prices rising steadily throughout that last week.

Graph F – Non-SDA Non-VAT sales – all lot sizes

Graph I – Non-SDA – 2020 – All lot prices against predicted BPS 2019 payment

1.4 NON-SDA NAKED ACRE LETTING

1.4.1 There were a number of clients who had surplus entitlements they did not wish to sell as they wished to ensure they maximised their BPS claim in 2020. There were others who were perhaps taking a gamble that the UK government might choose 2020 as the, or one of the, “reference year(s)” for the delinked payments that may be starting from 2022 under the proposals set out in the Agriculture Bill 2019-2020. For both types of clients the way to do this was to rent naked aces (and then buy entitlements to match if they were not already owned), and therefore we saw a renewed interest in this old type of scheme, which we had not had any demand for since 2014.

1.4.2 The first naked acre letting was agreed in mid-March with the tenant paying £50 per acre (£123.55 per ha) for a large area, with the added bonus to the landlord that the tenant wanted to sign up to a two year letting. By the end of March we agreed another letting at £60 per acre (£148.26 per ha), again for two years.

1.4.3 No lettings were agreed in April, however in May there was a surge of interest, and we agreed a further batch of lettings at £60 per acre, with the offers rising to £65 per acre (£160.62 per ha) at the end but without enough land available.

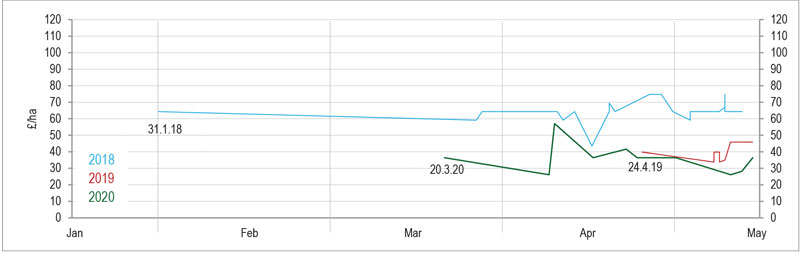

1.5 SDA

1.5.1 Demand was unusually weak for SDA entitlements for the 2020 season, as in 2019, continuing to buck the trend of the previous few years when there was never enough supply to meet demand. However the buyers that came to the market were still prepared to pay more for SDA than for Non-SDA entitlements, despite the SDA payment per ha being slightly less than the Non-SDA.

1.5.2 The first sales of SDA entitlements were agreed at the beginning of January at £200 plus VAT per entitlements.

1.5.3 By the beginning of March sales were being agreed at prices at £175 plus VAT and throughout March sales continued at around £175-180 plus VAT.

1.5.4 In early April there were some nervous sellers who started accepting lower offers, going as low as £150, however most sales continued to be at £170 – £180 plus VAT.

1.5.5 By early May, demand did pick up a little, and in the last couple of weeks leading up to the deadline, sales ranged from £150-180 plus VAT, with the last sale of the season being agreed at £160 plus VAT.

1.5.6 There was no major uplift in Non-VAT registered sale prices compared to VAT registered, however all non-VAT sales achieved at least £165 per entitlement. There were (unusually!) very few sales of non-VAT SDA entitlements.

1.5.7 The average price paid for 2020 SDA entitlements (of all lot sizes) over the whole of the trading season (Jan to May 2020) was £171 plus VAT.

Graph J – SDA – all lot sizes – VAT and Non-VAT registered sales

1.6 SDA MOORLAND

1.6.1 There was a good supply of Moorland entitlements available for sale from early in the trading season and sellers were initially hoping to achieve around £45-50, where the 2019 season had ended up. However as with the previous year, initially the demand was simply not there and the first sale was not agreed until late March at £35 plus VAT for a large lot.

1.6.2 In April one buyer was able to secure a large lot of 700+ moorland entitlements at £25 plus VAT where the seller had a large amount to dispose of before the deadline. Another buyer agreed to pay £55 plus VAT for a very small lot. However most sales agreed in April achieved £35-45 plus VAT.

Graph K – SDA-Moorland – all lot sizes – VAT and Non-VAT registered sales

1.6.3 In the last two weeks before the deadline, it remained fairly quiet however further sales were agreed with prices ranging from £25-30 plus VAT for the larger lot sizes, and the last sale of the year achieved £35 plus VAT.

1.6.4 The average price paid for Moorland entitlements over the whole 2020 scheme year was £34.70 plus VAT. This compared with the 2019 average of £39.

1.7 LEASING

In 2020 we did not do any leasing, as the purchase price (certainly for English entitlements) was low enough that most farmers were happy to buy them outright. We have found that RPA leasing has not proved to be popular since it was introduced in 2015, other than as a tool for a landlord to pass on entitlements temporarily to a tenant. There are risks for the lessor, should the lessee not make their claim correctly, and the lower payments being offered did not tempt those of our clients with surplus entitlements. There was however a resurgence in the Naked Acre letting market in 2020. (see Section 4 above).

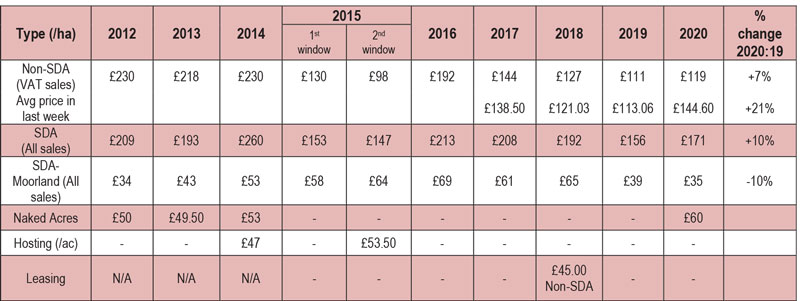

Table of comparative average sale and leasing prices for England

1.8 SCOTLAND

1.8.1 In Scotland, as with England, there are three different regions for entitlements, being Region 1 (better agricultural land), Region 2 (rough grazing) and Region 3 (rough grazing with an LFA grazing category A). Assuming the payment will be approximately the same as 2019 in 2020 Region 1 will be paying around £143 as the BPS element, plus greening if eligible (at approx. 30% on top), totalling around £218; Region 2 will be paying around £31 as the BPS element, plus greening, totalling around £43, and Region 3 will be paying £9 plus greening equivalent to around £12.90.

1.8.2 There was no siphon applied to the transfer of entitlements without land in 2020.

1.8.3 Applications to transfer Scottish entitlements are made using paper PF23 forms to be received by the RPID by the deadline of 2nd April 2020. Therefore transfers are processed manually, and this results in a long delay between submission of the application, and then confirmation of transfer which usually comes in July, well after the claim deadline. The SGRPID confirm that they aim to process all transfer forms before processing the BPS claims for 2020.

1.8.4 The Scottish Government has confirmed that the ‘convergence’ payment will apply to Scottish BPS entitlements in 2020 as it did in 2019. This payment consists of £160 million of CAP convergence payments which were wrongly diverted from Scottish farmers in 2013. For 2019, £52 million of this fund was applied across BPS claims representing an additional £15.86 per unit for Region 1, £24.09 for Region 2 and £6.28 for Region 3. A cap of £55,000 was applied to the Basic Payment element of individual entitlements. The exact figures which will apply to 2020 entitlements are not expected until 2021.

1.8.5 The Scottish government has so far declined to be part of the Agriculture Bill currently going through the UK Parliament, although there is the ability that they can become part it if they wish. However the noises from Holyrood seem to suggest that the BPS claims will continue in Scotland as they are currently for a number of years yet.

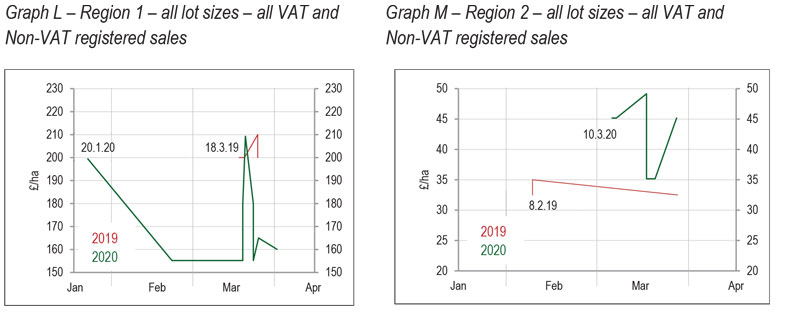

1.8.6 Region 1

1.8.6.1 There was a good supply of Region 1 entitlements from early in the season. However, as often happens, there was a slow start to trading with a frantic finish as BPS claims were left till the last minute.

1.8.6.2 The first sales of Region 1 entitlements were agreed in January between £180-200 plus VAT.

1.8.6.3 Throughout February the price dipped as a high number of vendors came to the market. Sales were agreed at £155-180 for small and medium lot sizes. Large sales were agreed at £150.

1.8.6.4 April saw last minute deals with large lots sell at £150-155. The average lot size sold in 2020 was around 31 entitlements. The average price for the season was £172.50.

1.8.7 Region 2

1.8.7.1 There was slow initial start for Region 2 entitlements, before a flurry of sales for medium sized lots agreed in early March at £45 plus VAT. Demand then remained high until the deadline with several large sales completed at this price.

1.8.7.2 The last sale of 45.43 ha of Region 2 entitlements was agreed at £45 plus VAT in the last few days leading up to the 2nd April deadline.

1.8.7.3 The average lot size sold in 2020 was 56 per deal. The average price for the season was £42.

1.8.8 Region 3

1.8.8.1 Region 3 entitlements were in unusually high demand in 2020 – at one point we were trying to source around 10,000 ha for a variety of buyers – but there was very little availability. Those sellers who had some Region 3 entitlements were achieving prices around £12-15 per unit, which was high compared to the payment the entitlements would attract (around £12.90 per unit before any additional “convergence payment”).

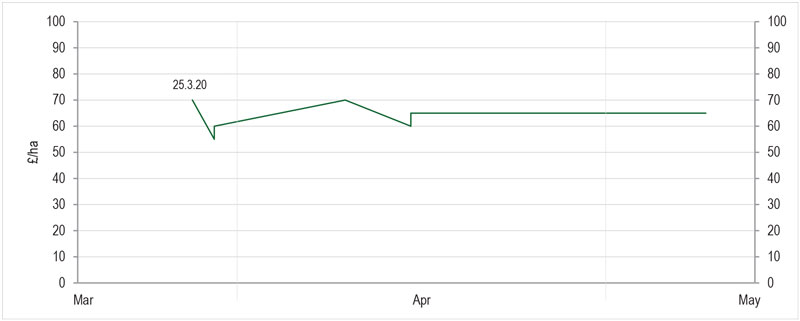

1.9 WALES

Graph N – 2020 Welsh entitlement sales – all lot sizes – VAT and Non-VAT registered sales

1.9.1 In Wales all land is classified as one Region with all Welsh BPS entitlements having the same flat rate value since 2019. The expected BPS and greening payment is expected to be the same as in 2019, £179 for the first 54 ha (including the redistributive payment), and then £87 per ha for the remaining claim, including greening. The redistributive payment is unique to Wales and is a mechanism whereby the first 54 ha of a claim attracts an additional £92 per entitlement. The redistributive payment will be increasing as a proportion of the total value, with the flat rate for an entitlement being scaled back.

1.9.2 The deadline for submission of an online transfer application for Rural Payments Sales was extended in 2020 from 30th April to the 15th May due to the Coronavirus.

1.9.3 After a slow initial start, demand was much higher than previous years. From March onwards there were more purchasers than vendors with some mid-sized non-VAT lots going for up to £70 per unit. From early April the sale price fluctuated between £55-60, and then from mid-April maintained a consistent £65 per unit until the close of the window. There were frequent requests to lease throughout the season, however the majority of vendors were set on selling and few took up this option. As ever, the Welsh entitlement represents outstanding value for the initial low outlay.

1.9.4 The average lot size sold through the trading period was around 22. The average sale price in 2020 was £65 plus VAT.

1.10 NORTHERN IRELAND

1.10.1 Northern Ireland entitlements are all classed as a single Region, but still have different values depending on their historic element. Northern Ireland’s entitlements move to a Flat Rate by 2021/2022.

1.10.2 The DAERA BPS handbook for 2020 confirms that the payment in 2020 will be the same for each claimant as it was in 2019, other than the historic element reducing and the flat rate element increasing as usual. The average payment per ha for the whole of Northern Ireland in 2019 was £229 per ha including greening, and is expected to be the same in 2020.

1.10.3 Theadline for submission of online (and paper) transfer applications was 4th May, as the usual 2nd May deadline fell on a Saturday.

1.10.4 There was extremely high demand for Northern Ireland entitlements right up until the deadline reflecting the trend with English entitlements. They traded at close to face value throughout the season, however higher value entitlements (which will be reducing in value) achieved closer to 0.8 x face value, and lower value (which will be increasing in value) achieved slightly higher multipliers.

1.10.5 Given the high sale prices, there was also a leasing market, and high value and mid value entitlements were leased at around 50% of their earning capability (i.e. BPS payment &. Greening).

1.10.6 The high demand could reflect the possibility of Northern Ireland maintaining the BPS scheme beyond the rest of the UK, as they have the option to maintain direct payments in their existing format.

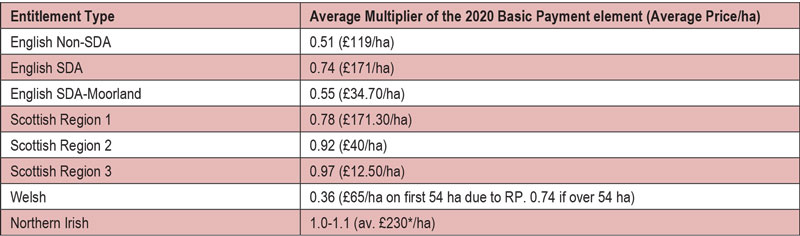

1.11 AVERAGE 2020 MULTIPLIERS OF MARKET VALUE V BPS PAYMENT RATES FOR ENTITLEMENTS SOLD ACROSS THE UK

1.11.1 Due to the historic payment element of BPS entitlements in Scotland, Wales and Northern Ireland as they move to a flat rate, these entitlements have in the past been sold using a multiplier, i.e. comparing the price of the entitlements to the payment they should attract in their first year of claim (and could also be viewed as a percentage of the actual payment) We call this the Regional Method. From 2019, however, England, Scotland and Wales all have flat rate payments, and only Northern Ireland retains an historic element which will be phased out by 2021/2022.

1.11.2 We have found it interesting to create a multiplier of the face value to market value for each type of entitlement for each region. This allows us to compare the relative worth of each type of entitlement across the UK on the same basis. For the 2020 year most agents used the 2019 BPS payment rates for the value of the entitlements. The multiplier in Northern Ireland was often further adjusted based on what type of value the BPS entitlements have, i.e. entitlements with a low value historic element have been increasing in value as they move towards the flat rate, and high value entitlements have been decreasing in value as they move to the flat rate.

1.11.3 For example English Non-SDA entitlements traded in 2020 (using the 2019 payment values as we are advised that 2020 will be paid at the same level) were based on a Basic Payment of £233. If an entitlement was sold at £119/ha, this would mean it had been sold at a multiplier of 0.51 x face value (of the total payment).

1.11.4 The multipliers below are therefore calculated based on the Basic Payment including Greening and the Redistributive Payment (Wales only)

* As the payment rates in the Northern Ireland vary due to the inclusion of an historic element we set out the “average payment” per ha over all of Northern Ireland, as advised by DAERA.

1.11.5 For 2020 the multipliers show Welsh entitlements were the best value for money, costing less than half the annual payment. Northern Irish & Scottish Region 3 entitlements on the face of it are the worst value for money costing the same or more on average than their payment value. However both Northern Ireland and Scotland also have perhaps a more certain plan to pay the BPS using entitlements for at least a couple more years and so they have perhaps a longer shelf-life (whereas Wales will be continuing for 2021 certainly as will England, although maybe sometime in or after 2022 the payment may be De-Linked and there may be no need for entitlements to be held in order to receive future payments).

1.12 RPA ONLINE ISSUES IN 2020 SCHEME YEAR

1.12.1 The English RPA online system has to cope with huge amounts of data, and has built within it rules which enable it to process certain transactions automatically, easing up on staff workloads and enabling most transactions to happen (in theory!) quickly and easily. Most transfer applications go through fairly smoothly, however no computer programme designer can foresee every possible scenario, and each year new issues arise that no-one has considered before. And there were, as usual, a number of glitches that arose during the 2020 entitlement transfer period.

1.12.2 In 2020 the online entitlement transfer screen went live at the end of January.

1.12.3 We noted that not all transfers submitted online received an automated confirmation of transfer message, but were assured by the RPA that as long as a transfer showed correctly on the seller’s entitlement transfer In and Out screen, then the transfer was effected and complete.

1.12.4 Stalled transfers due to sellers not claiming in 2019

We had one seller who had claimed on his entitlements in both 2018 and 2019, however he had his claim in 2019 rejected because an inspection decided he did not have enough eligible area (his claim was usually 5.88 ha) to reach the minimum 5 ha for a claim. He therefore wanted to sell the entitlements in 2020, but although we submitted the transfer application online successfully, the transfer went into Pending and was not confirmed. We had to contact the RPA to request they manually push through the transfer, which was being held up because his claim was rejected in 2019, and therefore his Entitlement Register was not updated on the RPA online system to show the entitlements as available for transfer. The issue of transfers needing to be pushed through manually by the RPA Entitlements Team came up a number of times over the season, usually due to the seller not making a claim in 2019.

1.12.5 Use-by date complications

1.12.5.1 We had a number of instances where entitlements that were showing as available to transfer on the seller’s Entitlements screen, but which were showing older use-by dates when you went to the Transfer application screen (i.e. 2019 use-by dates or even older). When we queried the RPA about these, we were advised that such anomalies were usually due to a different department running a Post Payment Adjustment (PPA) from a previous year on the seller’s entitlements. The RPA explained it as follows: The reason the use by year is showing as 2019 is due to post payment adjustment that was completed on the 2017 scheme year claim. Their 2018 and 2019 scheme year claims did not need post payment adjustment but has caused the entitlement blocks to show the use by as being 2019 (2017+2).

1.12.5.2 In most cases we were able to obtain reassurance from the RPA that we could transfer entitlements even with the wrong use by date showing, and they would be available to use in 2020 by the transferee. However there was one instance where the RPA confirmed that some of the entitlements should not be showing as available, as they were still working through the PPA, and we had to adjust the amount being sold accordingly.

1.12.6 Transfer screen timing out resulting in multiple transfers

There was an instance one evening where the RPA transfer screen timed out a number of times in the middle of submitting a transfer application. Unfortunately the next morning it became clear that despite not clicking “submit transfer application” on the sessions that had timed out, the computer had transferred the same lot between the parties 3 times. Thankfully upon contacting the RPA we were able to ensure the two incorrect transfers were cancelled.

1.12.7 Incomplete Entitlement history showing online

As in previous years, there were again a small number of instances where a client’s entitlement records were simply incorrect or missing. Generally we are advised by the RPA that this happens when another department is carrying out a review or PPA check on the claims previously paid out for that SBI. If the RPA start to investigate a claimant’s 2015 claim, and make adjustments, the “entitlements held” thereafter are not confirmed beyond 2017 (2015+2), because the Entitlement Register is updated for 2015 but not the following years, at least not until they have completed their PPA by reviewing all the claims after the 2015 one. Also the claim history is wiped out as they will then have to manually check the 2016, 2017 and so on claims against whatever adjustment they made to the 2015 claim.

2. UK CARBON TRADING – 2020

2.1 CARBON TRADING OVERVIEW

2.1.1 One of the most exciting new trading opportunities in recent years involves the trade of carbon credits. This market has huge growth potential with the Government setting targets of net-zero emissions by 2050.

2.1.2 The only UK-based system, so far, is the Woodland Carbon Code which has set Government approved standards for UK woodland creation projects, which the landowner can use to verify and then trade the carbon they sequester in the new woodland. This creates security for the purchaser who knows the carbon credit has been professionally validated.

2.1.3 The Woodland Carbon Guarantee scheme provides the landowner with a confidence that their captured carbon can be sold at a guaranteed minimum price via a contract with the Government or sold in the open market, whichever provides the best value.

2.1.4 Also one of the most attractive elements of creating new woodland is that BPS payments can continue on these areas when using the various grants available (including Countryside Stewardship Woodland Creation and Woodland Carbon Fund capital grant), provided the land was claimed on for Single Farm Payment in 2008.

2.2 TRADING VALUE

2.2.1 In previous years the UK carbon market consisted of businesses self-regulating their offsetting, purchasing credits as part of their individual corporate ‘green’ strategy. As such the market was unstable with inconsistent prices. Carbon credits sold under the Woodland Carbon Code previously fetched values of between £5 – £20/tCO2. Generally the cheapest prices were paid to landowners who quickly offloaded their credits to international trading firms speculating on the future market with an aim to “buy cheap and sell dear”. The highest were for carbon on particularly marketable sites by buyers keen to use their carbon for public relations. Note that these prices are for Pending Issue Units, which represent carbon which is not yet sequestered but likely will be in the future.

2.2.2 With the Government’s Woodland Carbon Guarantee, auctions have established for the first time a clear price for sequestered carbon. The most recent completed auction at the time of writing, held in June 2020, averaged £19.71 per unit among winning bids. In a typical commercial planting of Sitka spruce, if credits could be sold at this price on average over a 45-year term, this could bring in an additional £51 per acre per annum1. Another auction is currently ongoing. 1 [Figure estimated from Carbon Calculator provided by WCC, for a hypothetical woodland with the following assumptions: total area 110 acres comprising 60 acres Sitka spruce YC 16, 15 acres hybrid larch YC 10, 15 acres mixed broadleaves YC 8, 20 acres open ground; 90 acres tree guards, 110 acres herbicides and moderate disturbance soil preparation on semi-natural site with mineral soil. Registration, Validation and Verification, establishment and managements costs, and grant and timber sale income all excluded.]

2.2.3 Carbon capture

Carbon can be sequestered through a variety of land use activities. The most common units available are a result of woodland creation and verified by the Woodland Carbon Code. However there are opportunities for farmers to capture carbon through soil management and changing of farming practices. Peatland, agro-forestry and up-coming ELM schemes all have potential to capture carbon.

2.2.4 Carbon register

We currently have a register of carbon units to sell from individual farms. These types of unit are not currently part of a verified scheme but can still be used for voluntary offsets. They are a product of intensive soil management and crop rotations.

2.2.5 Market potential

Whilst the sponsoring of woodland creation and trading of carbon has existed in some form for many years, this market is set to flourish as Government policy and public opinion increasingly turn ‘green’. An increasing demand for credits means there is a need for innovative landowners and farmers with the ability to produce carbon credits and a desire to diversify and add an additional income stream to their business.

2.2.6 TCS Brokerage

2.2.6.1 As the UK’s leading broker for BPS entitlements we are now forging ahead in the Carbon trading market to create a more open and transparent trading platform where farmers and landowners will be able to ensure the best price for their Carbon. This will avoid City financial brokers being able to dominate the market as they did with solar and wind, reducing the returns to those owning what are increasingly now becoming recognised as the most valuable assets on our islands; the land, water and air.

2.2.6.2 Contact us if you are thinking of planting trees well beforehand for the latest Carbon market prices and how to go about getting them from the planning of a wood/forest through to a sale. Our team can help you with the planting grants available, how, what and where to plant, the registrations and costs involved and how and when to sell the Carbon.

2.3 WOODLAND CARBON FACT SHEETS

|

|

|

| Fact sheet 4 – Pre-planting options | Fact sheet 5 – Post-planting options | Fact sheet 6 – Guidance notes |

3. UK WATER ABSTRACTION LICENCE TRADING – 2020

3.1 OVERVIEW

The trading and transfer of water abstraction licences is a specialist practice, and our team has years of experience in this area with ex-Environmental Agency employee experience. This combines with our valuation, expert witness and litigation expertise and the UK wide market exposure only TCS Brokerage can offer with over 34 years’ experience of trading farm quotas/entitlements across the UK.

3.2 REGULATORY CONSIDERATIONS

3.2.1 Water abstraction (extraction) for industry, agriculture and drinking water is regulated by the Environment Agency (EA) through the abstraction licensing system. Abstraction licence trading allows a licence holder to sell their water rights to a third party within their catchment. This is beneficial because, with the exception of high-flow river water, no new licences are available throughout most of England and Wales. The only means of securing a new, year-round supply of water is, therefore, through an abstraction licence trade or by purchasing it from a water company.

3.2.2 The EA encourages licence trading because it allows them to allocate water resources in a way that meets demand and supports the environment without the abstraction of additional water. The EA is however, subject to the requirements of the Water Framework Directive which demands that they reduce licensed abstraction in areas where water resources are under stress and abstraction is unsustainable. Most of the rivers and groundwater supplies (aquifers) in the east and south east of England are calculated to have unsustainable levels of abstraction with large parts of Wales, the south west and north of England also affected. In an effort to return abstraction to sustainable levels the EA has recently started to use water trading as opportunity to reduce licence volumes. This policy has significantly suppressed licence trading activity in recent years.

3.2.3 Abstraction licence trades fall broadly into three types:

- ‘Water transfers’ where the abstraction licence is included within the sale of land.

- ‘Non-regulated trades’ where there is no requirement to change the terms or conditions of the licence, for example; supplying water by pipe to a neighbour to use for the same purpose.

- ‘Regulated trades’ where the point of abstraction or its purpose changes.

3.2.4 Because there is no requirement to change the terms and conditions of a licence in a ‘transfer’ or ‘non-regulated trade’ the EA has minimal involvement in these processes. ‘Regulated trades’ on the other hand, allow the EA to change the conditions of the licence including making quantity reductions.

3.3 RESTRICTIONS ON ABSTRACTION LICENCE TRADES

3.3.1 The EA generally limits the area in which trades can take place to within the same groundwater and river catchment. This is to ensure that abstraction impacts are not transferred from one catchment to another. Exceptions can be made if significant environmental benefits are likely to arise as a result of the trade.

3.3.2 Where the trade involves a change in purpose, the EA will apply a consumptive loss factor. This takes account of the change in the proportion of water that is returned to the environment after use. More water will be returned from vegetable washing, for example, than from spray irrigation and the quantities allowed for the trade will reflect this change in purpose. In water-stressed parts of southern and central England, the EA applies a sustainability reduction which caps the quantities allowed for a trade to the peak historic licence uptake between the years 2005 and 2015 (2000 to 2015 for spray irrigation). In the east of England where resources are even more stressed the EA caps tradable quantities to the average annual licence use between 2007 and 2012. The combined effect of these sustainability and consumptive loss reductions can mean that there is a significant difference between the amount of water stated on the licence and the amount available to trade.

3.3.3 Although the EA is taking steps to make licence trading easier, including the development of an online trading platform and the introduction of temporary (rapid turnaround) trades, the limits on the spatial extent of potential trades and the risk of losing a large part of the licence has placed a strong chilling effect on regulated trading activity. Informal (unregulated) trades are however, very common, particularly within the agricultural sector. Because of this informal nature, it is not possible to place a figure on the number of unregulated trades taking place but industry experts estimate that up to 25% of agricultural abstraction relies on traded water.

3.4 ABSTRACTION LICENSING 2020

3.4.1 The dry spring across the whole of the UK in 2020 caused many farmers to draw on their abstraction licences significantly earlier than usual and by early July many were beginning to run short of water. Heavy rainfall in the north and north west of the UK alleviated this problem for some, but the rain did not extend to the eastern side of the country, leaving many irrigators in the East and South East of England with high soil moisture deficits and insufficient water to finish their irrigation season. This increased interest in both temporary and longer term water trades in these areas

3.5 ABSTRACTION LICENCE ESTIMATED VALUE

3.5.1 The value of an abstraction licence can be broken down into its ‘asset value’ (the uplift in land or property value attributable to a licence) and its ‘use value’ (the amount a buyer will pay for use of the water). It is difficult to get a ‘fix’ on market values due to the informal nature of most trades and to the variations in local water demand and scarcity. ‘Asset value’ also varies according to the terms of the abstraction licence (including its expiry date and any constraining conditions) but as a rule of thumb, the increase in property value attributed to a licence is in the region of £10/m3.

3.5.2 Licence ‘use value’ depends largely on how the water is supplied. For agricultural irrigation in 2020, the ‘use value’ is approximately £0.45/m3 broken down as follows:

- Water right: £0.15/m3

- Supplied to field (pumps and pipeline): £0.15/m3

- Application as irrigation (including labour and machinery): £0.15/m3

3.5.3 Over the next 10 years, Water Framework Directive sustainability reductions will continue to decrease the quantity of water available for licensing and the government’s Abstraction Licensing Reform process is likely to erode existing protections on ‘licences of right’. These regulatory factors combined with the reduction in summer rainfall expected as a result of climate change will continue to put pressure on the UKs water resources, driving up both the asset value and use value of sustainable abstraction licences into the foreseeable future.

4. EMERGING MARKETS

4.1 BIODIVERSITY OFFSET

4.1.1 The Environment Bill will introduce a requirement for planning applications to meet a “biodiversity gain objective”. That is, they must somehow lead to a net improvement in biodiversity preferably at the site of the works, but elsewhere if this is not possible.

4.1.2 One way to do this will be to purchase “Biodiversity Offset” from a farmer or landowner, who will perform works to improve biodiversity on their holding in exchange for a payment.

4.1.3 These works might include Stewardship-style options such as wildflower meadows, hedgerow improvement or buffer strips around arable fields. More lucrative payments could come from larger-scale habitat creation such as rewilding, as these will enable larger and more expensive developments.

4.1.4 The Environment Bill, which will bring this new market to the fore, is currently moving through Parliament. Farmers who will have Biodiversity Offset to sell, i.e. who have parts of their holding they can alter to improve biodiversity, should contact us now to best make use of this opportunity.

4.2 NITRATE OFFSET

4.2.1 The Government announced a pilot scheme on the 11th September to enable development on the Solent in Hampshire. The development was prevented because of nitrate pollution to the River Solent.

4.2.2 To resolve this problem, the government is creating an online auction service for landowners to list potential environmental improvements to nitrate buffer sites in the area. Developers will bid to use these improvements to offset nitrate contamination from their developments. Landowners listing improvements will receive a payment from the highest bidding developer to put them into place. The developer can then use them to help attain planning permission.

4.2.3 Although this is currently a pilot scheme to be limited to one particular area, the government has suggested it may be expanded into other areas facing similar issues.

4.3 Although neither Nitrate nor Biodiversity offset is in place yet, please register your interest with us now to take advantage of these schemes as soon as they become available.

For previous year’s trading graphs/results and market reports please click here and scroll to the bottom of the page, then click on the item you would like to see.

The information in this report, whilst mostly applying at the time of the 2020 trading, is published in good faith as a broad comment only as at 09.11.2020 and should not be relied on without further professional advice and/or checking with the appropriate authority. Townsend Chartered Surveyors cannot be held responsible for any errors or omissions.

|

|

|

|

| Hugh Townsend FRICS. FCIArb. FAAV. | Mark Burton BA (Hons). MSc. | Alasdair Squires BA (Hons). | |

|

|

|

|

| Julia Clark BA (Hons). | Kathy Dean | Paul Bradford MSc. MCIWEM C.WEM | Michael J. Steed MICFor. MCIEEM. MArborA. |

|

Matford Centre, Matford Park Road, Exeter, EX2 8FD. Tel: 01392 823935 www.townsendcharteredsurveyors.co.uk PROPERTY AGENCY FARM & ESTATE MANAGEMENT PROFESSIONAL SERVICES PLANNING VALUATIONS TCS BROKERAGE RENEWABLES SPORTING

|