26.2.19 UK BPS ENTITLEMENT MARKET UPDATE

ENGLAND – SCOTLAND – WALES – NORTHERN IRELAND

ENGLAND – 2019 MARKET

Non-SDA

The entitlement market is continuing to warm up as we move towards March, with

buyers looking for nearly 700 ha of Non-SDA entitlements registering with our

firm last week alone. More sellers are also coming to the market, and in

the same week nearly 400 ha of Non-SDA entitlements were registered for sale

with this firm. At this stage in the season however we are facing the usual

“stand-off” between the two, whereby some buyers are making low offers in the

hope of bagging a bargain, but for now our sellers are standing firm in the

face of this pressure, as they still have nearly three months before the

deadline.

Sales agreed in the last couple of weeks have achieved prices of £150 plus VAT

for most small (i.e. less than 10) lots, £138-140 plus VAT for mid-sized to

larger (i.e. >10) lots, and a few sellers have agreed sales at prices of

£135 plus VAT for large lots.

The Brexit uncertainty is undoubtedly putting a cloud over the market, with a

lot of buyers quoting Brexit as why they will only make a low offer, but the

fact remains that the UK government has confirmed, in the Agriculture Bill

press release dated 12th September 2018, that: “For

2019, Direct Payments will be made on the same basis as now, subject to

simplifications where possible. Direct Payments for 2020 will also be made in

much the same way as now. Simplifications will be made as soon as possible,

subject to the terms of the overall Brexit implementation period. There will

then be an agricultural transition period in England between 2021 and 2027 as

payments are gradually phased out.”

Therefore a landowner buying entitlements in 2019 will receive a 2019 BPS claim

payment, subject to them submitting a valid application and complying with the

scheme rules, and also a payment in 2020. The € to £ exchange rate will affect

the payment received in 2019, however few commentators expect the pound to

rally against the Euro before this September, and so the favourable exchange

rate in the region of €1-£0.88-£0.90 will result, we predict, in a 2019 payment

very similar to 2018 in the region of £228 per ha (after FDM and any other

payment adjustments) for Non-SDA.

SDA

The SDA market is quiet so far this year, however it is a much smaller market

and often doesn’t get started until the BPS applications and associated maps

are made available on the RPA online. Some sales agreed before Christmas

achieved prices of £200 plus VAT per entitlements, however at present we have a

reasonable supply, and it may be sellers will accept offers in the region of

£180-200, depending on lot size.

Moorland

As with the SDA, the market is yet to take off for 2019, and with a good supply

available, prices are expected to be £50-65 plus VAT per entitlement, again

depending on lot size.

The deadline for trading 2019 English BPS entitlements is 15th May 2019.

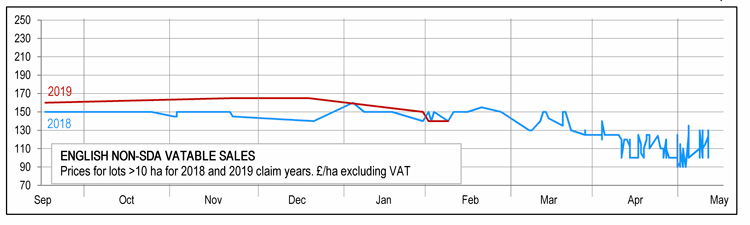

2019 English Non-SDA sales against 2018

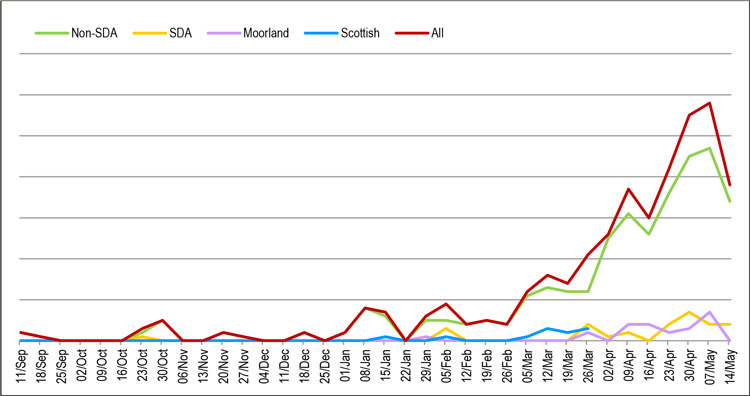

2018 Weekly flow of trade

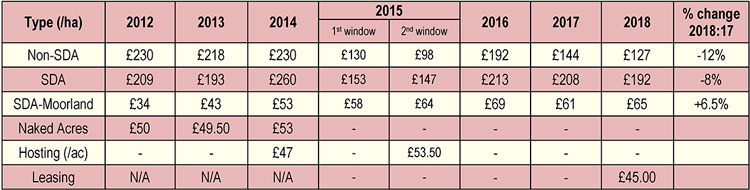

Table of comparative average sale and leasing prices for BPS entitlements in England 2012-2018

SCOTLAND

Since 2015 when the Basic Payment Scheme was first introduced,

the Scottish Government Rural Payments & Inspections Division (SGRPID) has

applied a siphon on the value of the entitlements when they were transferred

without land with the intention of reducing value of the different value

entitlements to the Flat Rate for each Region by 2019. Initially the siphon was

50% of the BPS element of the payment (i.e. excluding the greening element),

last year it was reduced to 30%, and technically the 30% siphon will be applied

again to 2019 entitlement transfers without land. However we have had

confirmation in writing from the Stornaway RPID office that, although the

siphon will be applied, “at some point in the year the entitlements would

then converge to the flat rate for the region” before the 2019 BPS

payment is processed, so in essence although the siphon will be applied, all

entitlements in each Region will be paid at the same level in 2019.

The market has been trading steadily at around face value, with Region 1

entitlements achieving £210-220 plus VAT, Region 2 around £32-35 plus VAT, and

Region 3 around £11-12 plus VAT, with there being particularly strong demand

for Region 2 entitlements. The market is not too busy at present, but with the

deadline of 2nd April for transferring entitlements fast

approaching, this is expected to pick up shortly.

WALES

Welsh entitlements (all one Region) have been trading at around

£70-80 plus VAT per entitlement, and many have also been sold at auction with

an average price of just under £70. This appears very low, as the 2019 payment

per ha (including the redistribute payment on the first 54 ha) is expected to

be around €255 (£225), and maybe £113 per entitlement after the first 54.

We believe the reason for the low price may relate to the way entitlements were

allocated in Wales in 2015, which has resulted in a surplus of entitlements

being available. Also there are usually many new entrant/young farmer

applications to the National Reserve every year, as families ensure they pass

on their farming businesses early to the next generation, often splitting farms

between sons and daughters. This of course adds to the pool of entitlements

available.

There is currently a good supply of Welsh entitlements, and the

closing date for transfer applications to be received is the 30th

April.

NORTHERN IRELAND

Northern Irish entitlements are all one Region however they

still have different values, depending on the historic value of each farmers’

entitlements, until they all reach a common Flat Rate by 2022.

The multiplier for sales is currently face value (of the BPS element of the

entitlement), plus the Greening payment. Therefore an entitlement with, say, an

average BPS payment value of €227, plus €100 greening, would be trading at £288

per ha plus VAT (based on the exchange rate of €1=£0.88).

The deadline for transferring Northern Irish entitlements is the 2nd May.