Now that the UK has left the European Union, DEFRA has been able to make modifications to the agricultural subsidy system. So far, this has mostly been through the well-publicised ELMS and Farming Investment Fund, and the reduction of the BPS. Until now, Countryside Stewardship has been relatively unaffected and relatively unmentioned. However, last week DEFRA announced striking changes to the Scheme’s payment rates. Striking in that they have largely increased.

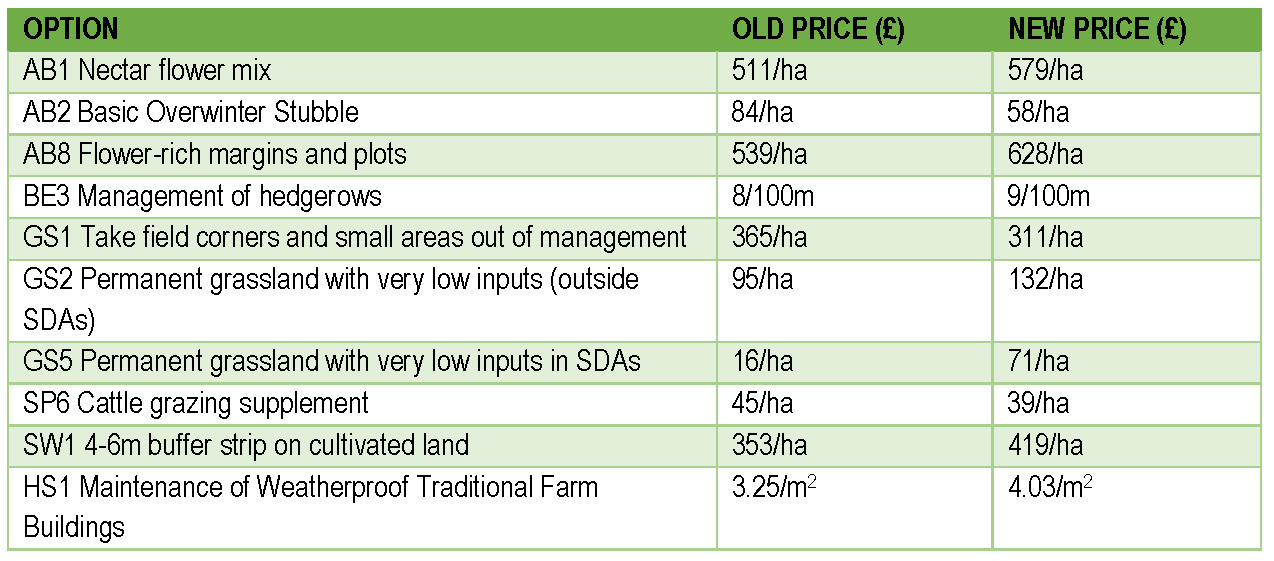

Changes to some of the most popular options are below:

While popular, GS1 usually only makes up a small proportion of those agreements where it is used, and SP6 must be combined with GS5 so farmers using these options will still see a substantial increase in income per hectare. The drop in the AB2 may be more significant, as this option makes up a significant part of many arable farmers’ agreements especially given that AB9 Winter Bird Food, another key arable option, has remained the same. Other options which have reduced in value include GS17 Lenient grazing supplement and GS15 Haymaking Supplement, to an extent that they will mostly offset the respective increase in GS2 and GS5 of those farmers applying for them.

Interestingly, for existing agreement holders and 2021 applicants, DEFRA will not apply the reductions, but will still apply the increases.

There is also some particularly interesting news for those considering moving their arable holding into organic production, with the conversion payment increasing from £175 to £256/ha and the maintenance payment increasing from £65 to £109/ha.

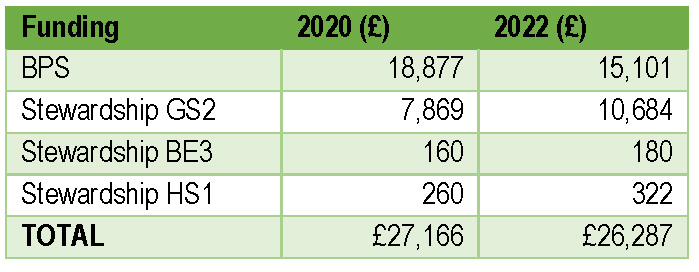

The changes have some interesting implications when compared with the Basic Payment Scheme’s tapering. Let us imagine a hypothetical extensive livestock farmer, with a 200-acre holding. Let us imagine that because their operation is extensive and their inputs are minimal, they have been able to put their entire holding into GS2, as is the case for many such farmers. They also have 2km of hedgerows under BE3, and a small 80m2 stone barn under HS1. Let us compare their grant funding in 2020, before any BPS reductions were made, with a projection for 2022, when their BPS will be reduced by 20%:

We can see that despite 20% BPS decrease, total receipts have only reduced by £879, or about £4.40/acre (before any inflation).

In other words, for many farmers who are part of Countryside Stewardship, these payment increases will go some way in offsetting upcoming losses from BPS. For some farmers in severely disadvantaged areas using the GS5 option, they may even outweigh the reduction for this year, leaving a net increase in government funding compared with before the BPS was reduced for no changes in operations.

We have often written that Countryside Stewardship will play an important role in weathering the storm of BPS reductions for many farmers, including those who had not previously considered it. Given that those who applied when this advice was made will enjoy the increases without suffering the reductions, this has turned out to be good advice.