2019 BPS ONLINE CLAIMS ARE NOW LIVE!

2019 Basic Payment Scheme (BPS) Guidance Booklet for England has now been released (see here) and online claim forms were available from yesterday.

This now joins Northern Ireland whose claims went live on the 1st March, and Wales on the 4th March, with Scotland going live from tomorrow, the 15th March.

UK ENTITLEMENTS – TRADING DEADLINES

The application deadlines are getting closer for those farmers/landowners who wish to sell or buy entitlements for the 2019 scheme year, and as a result we are now getting more interest from buyers who wish to ensure they have enough entitlements to match their land in 2019 to maximise their claims. The deadline for submission of Scottish paper transfer forms is 2.4.2019, for Welsh online transfers it is 30.4.2019, for Northern Irish online (or paper) transfers it is 2.4.2019, and for England online applications it is 15.5.2019. For current BPS entitlements available see here and BPS entitlements wanted see here.

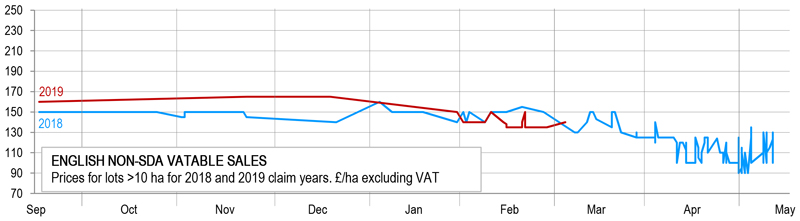

ENGLISH ENTITLEMENTS – TRADING UPDATE

English Non-SDA The market has been trading at around £135 (big lots over 50), £140 for mid-sized lots and £150-£165 for the small lots, and is now beginning to pick up with more farmers/agents ready to make firm offers (as opposed to “just looking”).

English SDA

The market has been quiet, but there has been an increase in the tentative enquiries from buyers who will be making offers once they have worked out their exact eligible areas now the online BPS claims and maps have become available online. The last sales agreed were at £200 plus VAT, and some agents have agreed sales at £180-£220 plus VAT.

English SDA Moorland

As with the SDA, there has been little demand in the last couple of months, however based on previous years’ prices the sale price is predicted to be between £50-65 per entitlement plus VAT, depending on lot sizes. Currently we have a good supply available.

Online Glitches and a Stop on Transfers to New Claimants/2018 Unpaid Claimants

We as a firm have been submitting transfer applications since the end of January 2019 when the transfer application facility went live on the RPA online, and we were surprised to see that several glitches that had caused problems in 2018 remained “unfixed” and were occurring again. Read more…

SCOTTISH, WELSH & NORTHERN IRISH ENTITLEMENTS – TRADING UPDATE

Scottish Region 1

These have been trading with a multiplier of around 0.9 – 1 (inc. greening), i.e. £190-220 plus VAT, depending on lot sizes.

Scottish Region 2

There is strong demand for Region 2 entitlements, and we have achieved sale prices of £30-35 depending on lot sizes.

Scottish Region 3

These are for the poorest quality land, and only attract a BPS payment of around £11 (inc. greening). However we do have buyers looking for large quantities if they are available, and we have offers at £15 per unit plus VAT.

Welsh (single Region)

The Welsh entitlement market has been fairly quiet. We have entitlements available at £65-70 plus VAT. Read more…

Northern Irish (single Region)

Northern Irish entitlements still have different values depending on the historic value of entitlements until they reach a common Flat Rate by 2022. The multiplier for sales is currently face value (of the BPS element plus the Greening payment), therefore an entitlement with an average BPS payment value of €227, plus €100 greening, is trading at around £280 per ha plus VAT. Read more…

ACTIVE FARMER TEST – ENGLAND, SCOTLAND, WALES & NORTHERN IRELAND

England

Whilst we reported this time last year that the Active Farmer Test had been removed from BPS 2018, there are still problems with the online system – Read more on Online Glitches here

Claimants should be aware that although the Active Farmer test has been removed they must, as a minimum, keep the land in a state suitable for grazing/cultivation, and must still comply with all Greening and Cross Compliance regulations, to successfully claim the full BPS payment. Read more…

For more information provided by the RPA, see here.

Scotland

In order to claim BPS in Scotland you must meet the legal definition of an “active farmer” and undertake at least the minimum agricultural activity on eligible hectares and meet cross compliance rules. Under the SGRPID rules a farmer is defined as a natural or legal person (or a group of natural or legal persons) whose holding (production units) are situated within Scotland. One must also exercise an agricultural activity, defined as an activity which can include the production, rearing or growing of agricultural products, including harvesting, milking, breeding animals and keeping animals for farming purposes. There are however some exceptions. Read more…

Following on from 2018, the “Negative List”, a list of certain banned activities making farmers ineligible for the Active Farmer status, e.g. claimants who operate permanent sporting and recreational grounds and other services such as railways or airports, remains removed.

For more information provided by the SGRPID, see here and click Active farming – undertaking agricultural activity and the “Negative List”.

Wales

To claim BPS or receive entitlements transferred by sale or lease, you must be a farmer and meet the Active Farmer requirements at the time of transfer/claim. The Active Farmer requirement does not apply to entitlements transferred via inheritance. If the recipient met the definition of a farmer and met Active Farmer requirements for the 2018 scheme year, the Welsh Government will consider that the requirements were met on the date the transfer took place in order to process the transfer. Read more…

For the most up-to-date information from RPW (published February 2019), see here and go to page 8.

Northern Ireland

To qualify as an Active Farmer in Northern Ireland it is required that claimants must be able to demonstrate that they have the decision making power, benefits and financial risks in relation to the agricultural activity on the land for which such allocation is requested. Evidence must be provided to confirm that you meet the active farmer requirements. Read more…

For the most up-to-date information from DAERA (published August 2018) see here

UK YOUNG FARMER TOP-UP PAYMENT

The Young Farmer top-up payment is different in all the UK regions.

England

In England the ‘Young Farmer’ payment is a top-up of 25% of the average value of all entitlements (not including the Greening element) that are held by an applicant and is applied to the first 90 entitlements that they use. In 2018 there was a change to the Young Farmer Payment rule in England in that the payment can be claimed for a maximum of five years from the first year a successful Basic Payment Scheme application is made, unlike in previous years in which the payment could only be received for five years from the year that the applicant took control of the farming business. See here for more detailed information.

To be eligible to claim the Young Farmer payment applicants must be at least 18 years old but not more than 40 in the year they first apply for the Basic Payment Scheme. They must be in control of the farming business in that they have over a 50% sharing vote (two young farmers can combine their votes to prove control of a business if their votes combined equal over 50%) or be a sole trader. The applicant must have made their first BPS application within five years of taking control of the business. Read more…

Scotland

A Young Farmer in Scotland can still receive a Young Farmer top-up payment for a maximum of 5 years from the date of their first application submission. See here for more information.

Wales

In Wales the Young Farmer applicant can claim the 25% top up on the first 25 hectares on the holding for 5 years from their first Young Farmer claim rather than the year they became head of the holding. See here for more information.

Northern Ireland

In Northern Ireland also, a Young Farmer top-up application can only be made for 5 years from the date a business was set up or the Young Farmer became head of the holding. See here for more information.

ENGLISH – 2019 BASIC PAYMENT SCHEME HANDBOOK

2019 Basic Payment Scheme (BPS) Guidance Booklet for England has now been released (See here). There are no changes from 2018.

ENGLISH – NATIONAL RESERVE ALLOCATION

The RPA allocate new entitlements to match “naked acre” eligible areas following a successful Young/New Farmer application. A Young Farmer must be 18 years old but not more than 40 in the first successful BPS application year, and in control (i.e. over 50% of the shares/votes) of a farm business who took control no more than 5 years before submission of their first successful BPS application. A New Farmer must be in control of over 50% of a business which started an agricultural activity in 2013 or later and was not in control of any farming activity in the previous five years, have made their first successful BPS application no later than 2 years after the year in which the business started.

ENGLAND DUAL USE

One party claiming BPS and another claiming under an agricultural agri-environment scheme the same land is allowed if the BPS claimant has the land “at their disposal”, agricultural environment scheme claimant has “management control” of the land and these arrangements are set out in writing.

ENGLISH – CROSS COMPLIANCE 2019

There has been no change from the 2018 guidance.