MARCH – UK 2017 BPS ENTITLEMENT UPDATE

Contents

|

1. Links 2. UK BPS Entitlements – User Guide 3. England Non-SDA 4. England SDA & Moorland 5. Leasing and Naked acres 6. RPA Online Transfers |

7. Common land – New Forest claims 8. 2015 Payment queries 9. BPS Claims – 2017 10. Disputes and Queries 11. Wales, Scotland and Northern Ireland

|

1. Links

To download/print a PDF of this newsletter click here.

UK 2016 Market Report; UK BPS Regional Comparison Fact Sheet; How to authorise us as your agent online; Current entitlements available; Current entitlements wanted; Summer 2016 newsletter; Christmas 2016 newsletter; Desktop English BPS payment card 2016, How to order UK BPS Entitlements – User Guide; January – UK 2017 BPS Entitlement Update

2. UK BPS Entitlements – User Guide

|

“Whether you are a practicing farmer, an accountant, a rural surveyor, a student, a land agent – or even an agricultural journalist – this book will become an invaluable tool for understanding the intricacies of agricultural support in the UK.” Philip Clarke, Executive Editor, Farmers Weekly “Townsend Chartered Surveyor’s expertise in this complex area is well-respected and this new, much needed, publication will become a ‘bible’ for all practitioners dealing with entitlements, the support system and the Rural Payments Agency. As the UK’s largest multi-professional organisation devoted to the law and business of the countryside, the Agricultural Law Association is pleased to endorse this book.” M R Holland MRICS, Agricultural Law Association “Entitlements to the CAP’s Single and now Basic Payments were created under EU law as another novel asset offering income but with a thicket of rules – and traps. In this guide, Hugh Townsend offers the experience of his specialist practice in handling these varied issues as found in each of the four parts of the UK.” Jeremy Moody, CAAV Secretary & Adviser |

To view sample pages please click here.

To order your e-book or hard copy paperback book of the User Guide please email kdean@townsendcharteredsurveyors.co.uk. The cost of the e-book is £40.00 (including VAT, receipted invoice only issued on request) and a paperback version of the book is also available at a cost of £40 (no VAT) including postage. Please note the e-book is an interactive digital book that cannot be printed out. Payments should be sent to Townsend Chartered Surveyors client account, sort code 12-20-26, account no. 06046475 with reference “UG EC” (for e-copy) or “UG HC” (for hard copy) and your name. If ordering a hard copy, please provide details of your postal address. If you have any queries please contact Kathy Dean on 01392 823935.

3. England Non-SDA

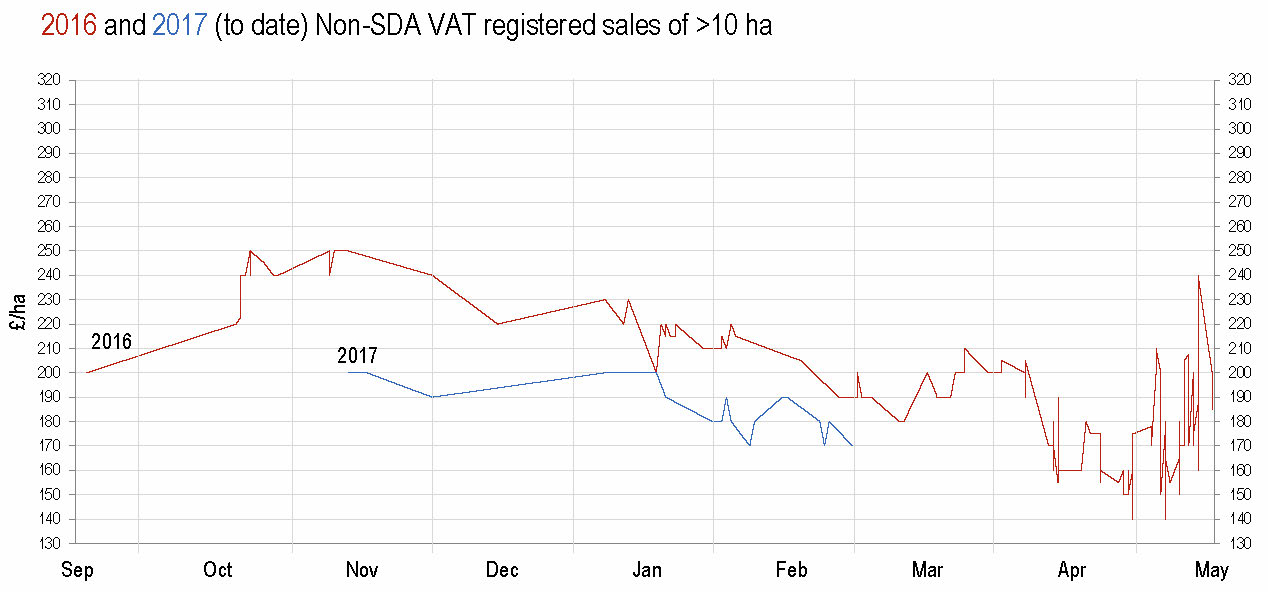

Since our January update, read more, trading activity has remained at a low level with prices dipping as low as £170 per hectare. Trade has however picked up in the last couple of weeks with prices rising since the RPA online transfer system has gone live, together with 2017 claims. It is still too early to tell whether this surge in interest will be the start of a revival in the price or merely a short term surge. The number of entitlements traded this year so far is currently 31.5% down on last year and therefore the Brexit gloom is having its effect. However for purchasers the threat in not buying now is that, at these historically low prices below the 2016 average price of £190, claimants and their agents may now pay more attention to calculating the total eligible area for their 2017 claim, and what entitlements they could claim against, thus increasing demand. Also, as claimants become more accustomed to using the RPA online application and transfer of entitlements system, now in its third year, it could be that the volume of trade will be still as high as last year but merely concentrated towards the deadline of the 15th May. The other threat to purchasers not buying now would be a deterioration of the unusually dry weather currently allowing work to continue uninterrupted on the farm in many areas of England, which will encourage claimants to address their claim and work out what more entitlement they will need, and therefore increasing demand. For vendors the threat is that Brexit continues to dampen demand for entitlements with continuing uncertainty as to what will happen to BPS after Brexit, and the threat of unfavourable indications as to the future of UK subsidies as negotiations start later this month with the EU. On the 8th March, the exchange rate if it stays the same until September, indicates a 2017 BPS payment of £217/ha which is suggesting a possible 14% return on the current purchase price within eight months, if the 2017 claim payment is received this December, with the 2018 payment being a further possible 100% return.

The CLA, in their 24th February update to members, suggested that the RPA had confirmed the final claim year for BPS will be 2019 in the UK. This seems to go further than the Chancellor’s statement last year that the UK government would match the funding that was available from the EU for 2019. However as yet the RPA have not been able to confirm the CLA’s comments which we understand may have come from an “off the cuff” briefing. Generally it is perceived by the market that BPS entitlements will continue as they are for a third year in 2019, but that the Government cannot make this announcement until negotiations are underway with the EU. It will, of course, be extremely difficult practically for the RPA to change the method of payment in respect to subsidies, dispensing the money promised by the Chancellor, bearing in mind the difficulties they already have handling the BPS scheme and their investment in the existing computer systems. To start up something new would be expensive and very difficult. Common sense therefore suggests that the easiest thing would be to continue things as they are for the final year of BPS whether we are in or out of the EU by that time.

4. England SDA and Moorland

The SDA and Moorland markets often take a while to pick up, but as at the 8th March, we have actually seen an increase in the traded volume compared to last year, with some big blocks already changing hands.

SDA entitlements remain in short supply and subsequently attract slightly higher prices than the Non-SDA market. Sales have been agreed in February at £185-£195, but now offers are being received and sales agreed at £200, although some vendors feel confident the market will rise to £220 by the end, and are holding out for these higher prices. Purchasers looking for SDA entitlements should ensure they register their interest early, as the availability often runs out before the deadline.

Moorland entitlements are in extremely high demand, but there is woefully little supply at the moment. Hopefully more will come on the books over the next couple of months to meet this demand. Offers currently being received are in the region of £50-60 per entitlement for the larger blocks of 100+, and higher again for smaller blocks needed to top up claims. With the 2017 payment value expected to be similar to 2016 of £56 (including greening after FDM), depending on the exchange rate which will be confirmed in September this year (and which at today’s date is actually slightly better than the 2016 one of €1 = 85p at €1 = 87p), purchasers would be looking at a profit by the second year’s claim.

To buy or sell SDA or Moorland entitlements, please contact Julia Clark.

5. Leasing and Naked Acres

Again whilst there is interest in leasing and naked acre letting this season as yet, there has been no trade.

6. RPA Online Transfers

The new 2017 RPA Online Entitlement screen and updated RPA Online help notes (V7.1.3.17) are now available to view, which are showing some improvements from last year. However we are already finding errors with the Entitlements screen and are awaiting the RPA to provide further explanation, therefore care still needs to be taken before relying on what is being shown.

This year the RPA online transfer system has been improved, showing historic information for 2015 and 2016 plus details of leasing. A further improvement is that there is automated confirmation of a transfer that follows the application online and this confirmation is now being received in some cases within hours of the application, unless there is some issue. There remains, as last year, queries with whether one can rely on what one is seeing on screen, and whilst the RPA appear to be suggesting one can, we are already finding anomalies and incorrect information, including what has been clawed back to the National Reserve.

7. Common land claims

There has recently been a surge of payments for 2016, but as yet no confirmation in respect to the New Forest as to any changes to the eligible areas available in 2017 following the mapping being queried, and still no news as to the compensation payment calculations following the Minchinhampton case.

8. 2015 Payment queries

We are increasingly being instructed to try and resolve outstanding 2015 payment queries, which can be as simple as an RLE1 form not being processed and fields subsequently not being included in a claim. Professional advice should be sought at this stage as entitlements could have been confiscated in 2015 that should not have been and claimants should reserve their position to claim damages from the RPA, together with losses as a result of 2016 claim payments being incorrect as well, having less entitlements to use.

9. BPS Claims – 2017

The claims have now started to be submitted, although further mapping issues are being discovered this year, and a considerable number of manual alterations are being required on the parts of the digital application that should be automated. Contact Dominic Rees by email (drees@townsendcharteredsurveyors.co.uk) for more details/information and/or if you would like help with your BPS claim.

10. Disputes and appeals

Frustratingly the RPA’s processing of complaints and appeals has slowed up with the number of problems mounting up from 2015 onwards and the time being needed in sorting out the remaining 2016 payments.

11. Wales, Scotland and Northern Ireland

Scottish

The entitlement market in Scotland has been operating steadily as of January this year, however it is yet to peak, with only a handful of deals taking place so far. Entitlements have been trading at a multiplier of around 1.25 times the value. The entitlement’s value is averaged over the remaining three payment years of the scheme and includes the 50% value siphon which is applied at the point of transfer. The trading deadline is just a matter of weeks away in Scotland, as paper forms continue to be used to transfer entitlements. All paperwork must be completed and received by Rural Payments and Services prior to Monday 3rd April, to ensure they are processed within the six week period prior to the 15th May claim deadline. With the imminent trading deadline buyers and sellers are encouraged to get on with calculating their claims (even though the deadline for these is the 15th May), given the time it can take to complete the necessary paperwork.

Wales

The Welsh entitlement market has been more active than in Scotland, with more entitlements changing hands since the turn of the year. Multipliers at this stage are ranging from 1.2 to 1.4 times the 2016 Euro value, with varying lots sizes and values becoming available. A significant number of entitlements are reducing in value as they reach the flat rate by 2019, although the anticipated redistributive payment, which is paid on the first 54 hectares of each claim year, is expected to be €77.20 in 2017, €103.24 in 2018, and €129.43 in 2019. There are still some weeks left of trading, as the deadline is midnight on the 2nd May, with the claims needing to be submitted online by the 15th May.

Northern Ireland

Trading in Northern Ireland has been buoyant as of January. Entitlements can be transferred by either paper forms or using the online system. At this point the online system however is not up and running although it is due to be launched imminently. Entitlements have been trading for around 1.4-1.5 times the value. Entitlement values continue to converge to a flat rate, although this will not be achieved during the current scheme. The entitlement transfer deadline this year is the 2nd May with claims needing to be submitted online or by paper before the 15th May.

TOWNSEND CHARTERED SURVEYORS